Introduction

Want to protect your assets, save on taxes, and grow smarter? At FormationsHunt, we empower UK entrepreneurs and global investors to unlock the power of holding companies with our All-Inclusive Package for seamless Company Registration in the UK. This game-changing structure is your key to strategic control and financial success. Let’s explore what a holding company is, how it works, and why it’s your next big move with Company Registration in the UK.

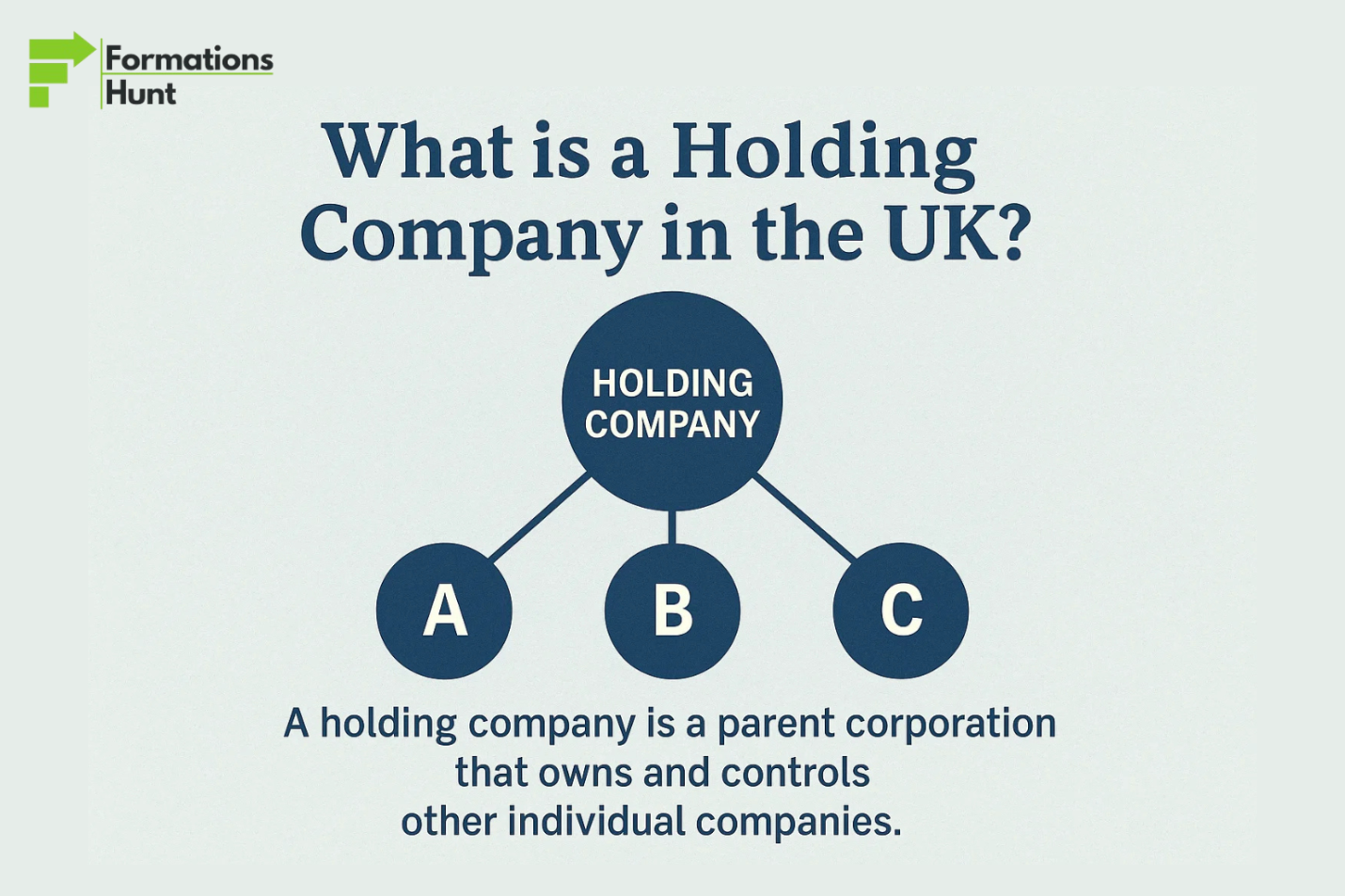

What is a Holding Company?

A holding company is a UK-registered entity, usually a private limited company (Ltd), that owns shares or assets of other businesses, called subsidiaries. Rather than engaging in the sale of goods or services like trading companies, its main role is to manage and control the businesses. Registered with Companies House, they streamline control while subsidiaries run daily operations.

How Does a Company Qualify as a Holding Company?

As per the Companies Act 2006 (sec. 1159), a company qualifies as a holding company if it meets one of these criteria:

- Owns more than 50% of the votes in a subsidiary.

- Is a member of the subsidiary and can appoint or remove a majority of its board.

- Controls voting rights via agreements with other shareholders.

These conditions make it a parent company, ensuring legal control over subsidiaries.

What Assets Does a Holding Company Own?

Holding companies manage valuable assets instead of trading goods. These include:

- Shares in subsidiaries or other corporations.

- Real estate, like properties leased to subsidiaries.

- Ideas or creations like patents, trademarks, or copyrights

- Financial instruments, like bonds or private equity funds.

These assets are managed to maximize value and minimize risk.

How Do Holding Companies Work in the UK?

Picture owning multiple retail brands under one roof. A holding company acts as the parent, holding significant shares (usually over 50%) to guide strategy, manage assets like property or patents, or set group goals. It leaves daily operations to subsidiaries. At FormationsHunt, we simplify UK holding company setup, ensuring compliance and alignment with your vision.

Example: A UK family business uses a holding company to own factories while subsidiaries handle production, protecting assets and enabling growth.

Why use a holding company – what are the Benefits and Tax Advantages?

Holding companies offer powerful benefits:

| Benefit | How It Helps |

| Tax Savings | Use group relief to offset subsidiary losses against profits. Dividends are often tax-exempt. The Substantial Shareholding Exemption allows tax-free disposal of 10%+ shares held for 12 months (if both companies are active). |

| Risk Protection | Assets in the holding company are shielded from subsidiary debts, safeguarding wealth. |

| Streamlined Control | Manage multiple businesses under one entity for easier growth or restructuring. |

| Post-Brexit Edge | Leverage the UK’s stable tax regime to attract global investment. |

These make holding companies a strategic choice for scaling businesses.

Tax Liabilities of a Holding Company

While tax advantages shine, holding companies face key obligations:

- VAT Exemption: Functions like acquiring shares or receiving dividends are VAT-exempt per HMRC, preventing voluntary VAT registration.

- VAT Registration: If providing taxable supplies (e.g., management services), voluntary VAT registration is allowed. Compulsory registration applies if taxable income exceeds £90,000 (2025 threshold).

- Corporation Tax: Taxable profits face corporation tax (19-25% based on profits).

- Compliance: Accurate filings with HMRC and Companies House are mandatory.

We ensure seamless compliance.

Step-by-Step: How to Register a Holding Company in the UK

Setting up a holding company is like building a fortress for your assets. We make Register a Business UK fast and flawless:

- Choose a Unique Name: Pick a brandable name and use our online name checker to confirm availability. “Holding” is unrestricted since 2015.

- Select a Structure: Most choose a Limited Company (Ltd). Keyword: Ltd Company Registration.

- Appoint Key Roles: Name at least one director and one shareholder.

- Choose the Right SIC Code: Use 64209 – Activities of other holding companies.

- Register with Companies House: Our digital submission ensures zero errors and approval in hours.

Non-Residents? No Problem! Our Non-Resident Package lets anyone worldwide set up a UK holding company in hours, including:

- UK Registered Office Address

- Director’s Service Address

- Business Mail Forwarding

- Register for VAT (if your taxable sales go over £90,000)

- Free Domain (.com or .co.uk)

- Worldwide Document Delivery

- Etc.

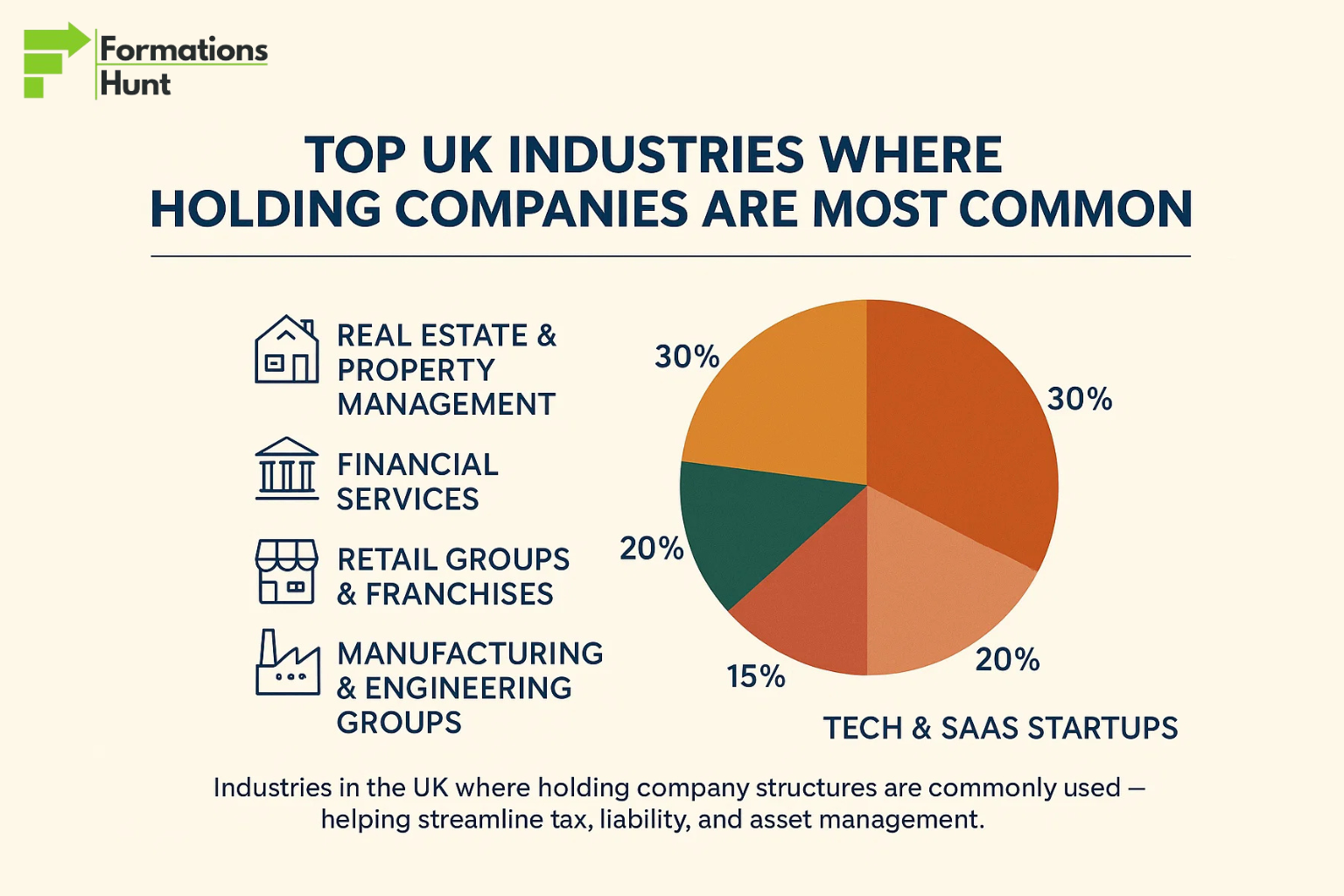

Common Uses of Holding Companies

Holding companies excel in:

- Property Investment: Own real estate leased to subsidiaries for income.

- Family Businesses: Centralize assets for succession planning.

- Multinationals: Manage UK and global subsidiaries efficiently.

Case Study: The Smith family’s UK bakery chain uses a holding company to own shop properties, protecting assets from risks. Subsidiaries handle baking and sales, with FormationsHunt ensuring a hassle-free Company Registration in the UK. Result? Tax savings and a secured legacy.

Challenges and Considerations

Holding companies have hurdles:

- Compliance: Annual filings with Companies House and HMRC demand precision.

- Costs: Fees for setup, accounting, and legal support apply.

- Complexity: Managing multiple entities requires clear governance.

We eliminate stress with expert guidance and transparent pricing.

Why Choose Us?

We’re your partner in building wealth and security. Here’s why we lead:

- Global Reach: Our Non-Resident Package serves clients from Dubai to Delhi.

- Lightning-Fast: Register your holding company in hours, not days.

- Expert Guidance: We handle SIC codes, VAT, and more with precision.

- 100% Customer Satisfaction: Real People. Real Results. Real Satisfaction. We’re proud of our 100% satisfaction rate. Our clients say it best:

Rehmaan: “Very smooth, seamless experience. The team made it so easy and fast, I was looking for something exactly like this. They’ve been very prompt and helpful both on chat and email, and the website filing process is very clear. I found them on the Companies House agents list, and I’m glad I picked them for my firm registration.”

Sampat: “Excellent assistance with company registration process. Ensured all details were correctly reviewed and submitted without errors. Maintained a positive, helpful attitude that made the experience genuinely pleasant.”

Adedayo: “Excellent services rendered. ⭐️⭐️⭐️⭐️⭐️ Excellent Support! FormationsHunt Ltd helped and guided me through registering for PAYE as an employer, and also helped me request the authentication code for my company. Their support was clear, friendly, and very efficient. I highly recommend their service!”

Whether you’re a UK startup or global entrepreneur, we deliver clarity, speed, and trust.

Conclusion

A UK holding company unlocks tax savings, asset protection, and strategic control for growth in 2025 and beyond. With FormationsHunt, your UK holding company setup is simple and tailored. Start your Company Registration in the UK today and build a smarter future.

Ready to launch your holding company?

Visit formationshunt.co.uk to register a UK business with an expert guide in minutes. Let’s shape your success together!