Why Price & Time Go Hand in Hand

In August 2025, two U.S. importers moved similar volumes of electronics from Shenzhen to Los Angeles.

One saved $2,800 in freight costs without extending delivery time — simply by switching from an under-filled FCL to a shared LCL service and avoiding a high-fee inland trucking route.

The other paid 18% more for freight and still arrived four days late, because they booked last-minute during peak season and stuck to their default port choice.

When it comes to freight shipping from China to USA, price and time are inseparable.

Chasing the lowest rate without considering transit time can hurt your cash flow and cost you sales. Likewise, paying premium for speed without measuring the return on investment can quietly erode your margins.

This guide is designed to help you strike the right balance — so you can move your goods at the best possible price without compromising your delivery deadlines.

We’ll break down average 2025 freight rates and transit times for ocean, air, and express courier; explore what drives those prices up or down; and give you tested cost-saving strategies that don’t sacrifice speed.

By the end, you’ll have a clear framework for deciding when to save, when to spend, and how to negotiate the smartest shipping deals in today’s volatile China–USA freight market.

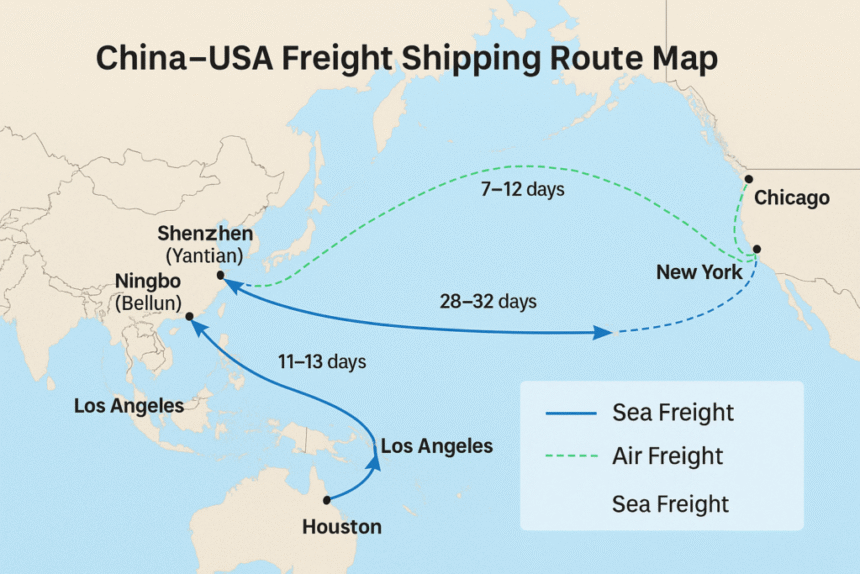

Freight Shipping from China to USA: Cost & Time Overview

Before you start negotiating with a freight forwarder, it’s essential to know what “normal” looks like for both price and transit time in 2025.

This gives you a benchmark to spot overpriced quotes — and helps you decide whether a faster (and pricier) service is actually worth it.

Below is a realistic 2025 reference chart for common shipping modes. Rates are average market prices in August 2025 for standard goods, excluding insurance and duties.

| Shipping Mode & Service Level | Port-to-Port Time | Door-to-Door Time | Average Cost (USD) | Best For |

|---|---|---|---|---|

| Sea Freight — Superior FCL (West Coast) | 11–13 days | 15–18 days | $2,500–$3,000 (40FT) | Urgent bulk shipments with fixed deadlines |

| Sea Freight — Normal FCL (West Coast) | 18–20 days | 25–30 days | $1,800–$2,400 (40FT) | Large but non-urgent cargo |

| Sea Freight — LCL (West Coast) | 14–20 days | 20–35 days | $0.82–$1.58/kg | Small shipments under full-container volume |

| Sea Freight — FCL (East Coast) | 28–32 days | 35–40 days | $3,200–$4,100 (40FT) | East Coast delivery with minimal inland trucking |

| Air Freight — Standard | – | 7–12 days | $7.10–$9.10/kg | High-value or seasonal goods |

| Air Freight — Express | – | 3–5 days | $8.80–$11.50/kg | Ultra-urgent deliveries, prototypes, replacements |

| Express Courier (DHL/FedEx/UPS) | – | 2–5 days | $15–$35/kg | Samples, small urgent orders |

Key Takeaways:

- Sea Freight = Cheapest but slowest — works best for planned inventory replenishment.

- Air Freight = Speed at a premium — ideal for high-margin, time-sensitive products.

- Express = Fastest but costliest per kg — best for small, urgent, high-value parcels.

- Port Choice Matters — picking the wrong arrival port can add 10+ days to delivery and increase inland trucking costs by 20–30%.

Pro Tip: Always check current shipping rates before booking. Seasonal surcharges and fuel adjustments can push these averages up by 15–25% during peak shipping months.

What Drives Freight Costs from China to USA

Shipping prices aren’t random — they move based on a mix of market forces, route choices, and shipment details.

If you understand what pushes your quote up or down, you can negotiate smarter and plan your logistics budget more accurately.

- Shipping Mode & Service Level

- Sea vs Air vs Express: Air and express are faster but carry higher per-kilo rates.

- Service tiers: “Superior” sea freight costs more but cuts days off transit.

- Distance & Port Choice

- West Coast ports = shorter sailing times but higher inland trucking for East Coast deliveries.

- East Coast ports = longer sailing times but can save thousands in inland freight.

- Container Type & Load

- FCL vs LCL: Full containers are more cost-effective for large shipments.

- Container size affects total vs per-unit cost.

- Seasonality & Demand Spikes

- Peak seasons push rates up 20–50%.

- Off-peak months offer lower rates and faster booking.

- Special Cargo Requirements

- Hazardous, temperature-controlled, or oversized goods require special handling.

- Insurance, while optional, is smart for high-value or fragile shipments.

Pro Tip: Ask your freight forwarder about upcoming holidays, fuel adjustments, or port slowdowns before booking.

How to Save on Freight Without Slowing Down Delivery

Cutting costs doesn’t have to mean adding weeks to your timeline.

The right mix of route planning, service selection, and cargo management can keep both your budget and your schedule intact.

- Mix Shipping Modes for Balance

Example: Ship 80–90% of inventory by sea for cost efficiency, but send 10–20% by air to keep stock moving while the ocean freight is in transit.

Result: Reduced warehouse costs in the U.S. and no sales interruptions. - Ship During Off-Peak Windows

Avoiding peak-season surcharges can save thousands per container.

Best Windows: Mid-April to June, and September to early October.

Action: Lock in bookings early in these months and negotiate for “all-in” rates. - Optimize Container Utilization

Half-empty containers waste money.- FCL: Consolidate orders from multiple suppliers in China.

- LCL: Use a freight forwarder with strong consolidation networks.

- Choose the Right Port for Final Delivery

Sometimes a longer sea route is cheaper overall.

Pro Move: Run a full landed cost calculation before deciding — include inland transport, storage, and delivery timelines. - Work with a Negotiation-Strong Freight Forwarder

An experienced freight forwarder can secure better rates and provide up-to-date insights on shipping conditions before booking.oking.

Case Study: Saving $1,200 Without Adding a Day

In May 2025, a U.S.-based electronics distributor faced a tight margin on a 2×40FT shipment from Shenzhen to Chicago. The priority was cutting costs without delaying the planned delivery date.

The Challenge

Route: Shenzhen → Chicago (via Los Angeles, then rail)

Problem: Peak-season ocean rates were high, trucking costs from LA to Chicago had surged 18%.

Deadline: Product needed to hit Chicago warehouses in 32 days or less.

The Strategy

- Alternative Port Selection: Switched to Houston for better rail rates and fewer delays.

- Service Level Adjustment: Booked “Fast” FCL instead of “Superior” — saving $600 per container.

- Container Optimization: Combined two suppliers’ goods to fill containers fully.

- Real-Time Market Check: Used GORTO Freight’s tool to confirm rates and port status before booking.

The Result

- Total Savings: $1,200

- Delivery Time: 31 days — one day earlier than expected.

Hidden Costs to Watch Out For in Freight Shipping from China to USA

Even the best-planned shipment can blow past budget if you overlook extra charges.

- Port Handling Fees – $200–$500 per container.

- Customs Exams & Storage – Costs and delays from inspections.

- Demurrage & Detention – $150–$300/day for late container pickup.

- Inland Trucking Surcharges – Fuel, tolls, and driver shortages impact cost.

- Surcharges & Currency Fluctuations – Extra fees from carriers and exchange rates.

Pro Tip: Always ask for an “all-in” quote covering freight, surcharges, and estimated destination charges. Compare multiple quotes to ensure you’re getting the best overall deal.

Conclusion — How to Balance Cost & Speed for Long-Term Gains

In trans-Pacific trade, cost and speed are two sides of the same coin. Chasing the lowest rate without considering delivery time can stall your supply chain. On the other hand, paying for the fastest possible service on every shipment can drain your margins.

The smartest importers view freight shipping from China to USA as an ongoing optimization process rather than a one-time decision. They track real transit times, compare them to landed costs, and adjust service levels based on product type, season, and customer expectations.

By building relationships with experienced freight forwarding partners, you gain the flexibility to pivot when market conditions shift. That agility — not simply picking “fast” or “cheap” — is what keeps your business competitive in 2025 and beyond.