Navigating the world of finances can often feel like walking a tightrope, especially when it comes to cashing checks. Among the various types of checks, cashier’s checks hold a special place due to their reliability and security. But timing is everything! Knowing when to cash in your cashier check sample can make all the difference in ensuring you get the most out of your funds.

Whether you’re planning a big purchase or managing business transactions, understanding the nuances behind these financial tools will empower you to make informed decisions. So let’s dive into what makes cashier’s checks tick and discover how timing plays a pivotal role in maximizing their benefits!

What is a Cashier’s Check?

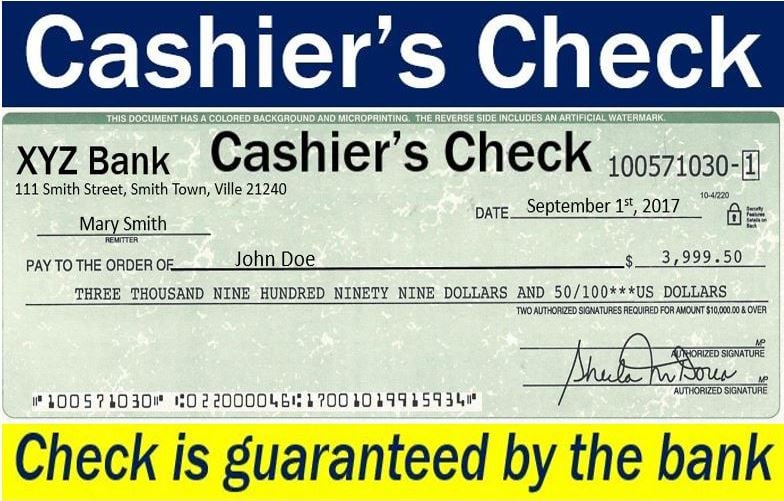

A cashier’s check is a special type of payment instrument issued by a bank. Unlike personal checks, which rely on the account holder’s funds, a cashier’s check guarantees that the money is readily available.

When you request one, the bank withdraws the amount directly from your account and writes it in its name. This process provides both parties with security: the payee knows the funds are secure from bouncing.

These checks are often used for large transactions like real estate purchases or vehicle sales due to their reliability. Since they carry less risk than other forms of payment, many sellers prefer them over personal checks.

Additionally, cashing a cashier’s check typically requires fewer verification steps compared to other financial instruments, making it an efficient choice for quick transactions when time is essential.

Importance of Cashing Checks at the Right Time

Cashing a check at the right time can make a significant difference in your finances. Timing affects when funds become available and how you manage your budget.

Many banks have different policies regarding hold times for checks. If you wait too long, those holds could affect immediate access to your money. It’s essential to understand the bank’s processing schedule.

Additionally, cashing checks promptly helps protect against potential issues such as lost or expired checks. The longer you wait, the greater the chances of complications arising.

For personal expenses or business needs, being timely ensures that payments are settled without delays. This is crucial for maintaining good relationships with vendors or service providers.

Moreover, timely cashing helps keep track of spending and financial planning efforts organized. Knowing exactly where your money stands allows for better decision-making down the line.

Factors to Consider When Timing Cashier’s Check Samples

Timing is crucial when it comes to cashing a cashier’s check. One key factor to consider is the recipient’s urgency. If they need funds quickly, it’s best to process the check as soon as possible.

Next, think about bank hours and holidays. Cashier’s checks may take longer to clear on weekends or during public holidays. Knowing your bank’s schedule can save you unnecessary delays.

Another aspect is the validity of the check itself. Most cashier’s checks have an expiration period, typically ranging from 90 days to a year. Keeping track of this timeframe ensures you don’t miss out on accessing your money.

Market conditions can impact timing too. For personal transactions tied to specific events—like buying a car or making a down payment—it pays off to align your cashing with these important milestones for smooth execution.

Pros and Cons of Cashing Checks at Different Times

Cashing checks at different times can significantly impact your financial experience. Early in the day, for instance, banks tend to be less crowded. This means quicker service and potentially fewer delays.

However, cashing a check late in the day might work better for some. You can maximize that day’s funds before any pending transactions hit your account.

On weekends or holidays, many banks are closed. If you wait until then to cash a check, you’ll miss out on immediate access to those funds.

Timing also affects how soon funds become available. Cashing during business hours typically results in faster processing compared to after-hours deposits.

Additionally, if you’re working with cashier’s checks specifically, knowing when to deposit them is crucial. Some institutions release funds immediately while others may take longer due to their policies regarding verification and fraud prevention measures.

Best Time to Cashier Check for Personal Use

When it comes to using a cashier’s check for personal needs, timing can make all the difference. Many people find that weekdays offer the best opportunities. Banks are generally less crowded during weekday mornings.

Choosing mid-month is another smart strategy. Bills tend to cluster around month-end, so cashing your check earlier can mean more available funds when you need them most.

Consider bank hours as well. Some banks close early on weekends or have limited hours that could affect your plans.

If you’re planning a significant purchase, like a car or appliance, aim to cash your check right before the transaction. This helps ensure you have immediate access without delays in processing time from the bank.

Be mindful of holidays and special events; they can alter normal banking operations and unexpectedly delay your plans!

Best Time to Cashier Check for Business Transactions

When it comes to business transactions, timing is crucial. The best time to cash a cashier’s check often coincides with the financial calendar of your organization.

Consider cashing the check early in the week. This allows for immediate access to funds, which can be particularly beneficial if you’re looking to seize new opportunities or settle urgent expenses.

Be mindful of month-end and quarter-end periods. Many businesses experience increased transaction volumes during these times. Cashing checks when demand is high could lead to delays.

Additionally, consider bank hours and holidays. Knowing exactly when your bank processes checks ensures you won’t be caught off guard by unexpected wait times.

Aligning your cashing schedule with your business needs will help smooth out operations while maximizing available resources.

Conclusion

Cashing a cashier’s check requires careful consideration. Timing can significantly impact not only the speed of access to funds but also the security and convenience surrounding your transaction.

Understanding what a cashier’s check is, and recognizing its importance in both personal and business contexts, plays a critical role in determining when to cash it. By weighing factors like bank policies, your immediate financial needs, and even market conditions, you can make smarter decisions.

For personal use, it’s often best to cash during regular banking hours for optimal service. For business transactions, aligning with payment cycles or vendor expectations can lead to smoother operations.

By taking these insights into account, you can better navigate the process of cashing checks efficiently while minimizing risks associated with timing missteps. Prioritizing thoughtful planning will ultimately lead you toward more successful financial outcomes.