swish qr code

In a world where convenience reigns supreme, payment technology has rapidly evolved to keep pace with our fast-moving lives. Enter the Swish QR code, a game-changer that combines the simplicity of scanning with the efficiency of mobile payments. Gone are the days of fumbling for cash or card readers; now, all you need is your smartphone and a quick scan to make transactions smoother than ever. As businesses embrace this modern solution, it’s time to explore how Swish QR codes can not only streamline payments but also enhance customer experiences in ways we never thought possible. Get ready to dive into this digital revolution!

The Evolution of QR Codes

QR codes, or Quick Response codes, emerged in the mid-1990s as a way to track automotive parts. Their ability to store information efficiently made them invaluable in manufacturing industries.

As smartphones gained popularity, QR codes transitioned from industrial uses to everyday consumer applications. Suddenly, anyone could scan these black-and-white patterns with ease. This opened the door for marketing and advertising opportunities.

The introduction of mobile payment systems further propelled QR code usage into mainstream consciousness. Today, they are ubiquitous—appearing on everything from product packaging to restaurant menus.

With each advancement in technology, QR codes have grown more versatile. They now link directly to websites, social media pages, and even facilitate contactless payments through platforms like Swish. As our digital landscape continues evolving, so too does the potential for this simple yet powerful tool.

What is a Swish QR Code?

A Swish QR Code is a digital tool designed for seamless payments. It operates through the Swish mobile payment system, popular in Sweden. This code provides an easy way to send and receive money using just a smartphone camera.

When scanned, the Swish QR Code directs users to a specific payment request. Users can quickly complete transactions without needing to enter lengthy bank details or amounts manually.

The codes are highly versatile, suitable for various scenarios—from shops accepting quick payments to individuals splitting bills among friends.

As technology evolves, so does the use of these codes. They bridge the gap between traditional banking and modern digital solutions, making everyday transactions smoother and faster.

Benefits of Using Swish QR Codes

Swish QR codes offer a seamless payment solution, making transactions faster and more efficient. With just a quick scan, users can send or receive money instantly. This eliminates the hassle of cash or card payments.

Another significant advantage is accessibility. Swish QR codes are easy to generate and share across various platforms. Whether through social media, email, or printed materials, businesses can reach customers effortlessly.

Moreover, they enhance customer engagement. By using these codes in marketing campaigns, companies encourage interaction and facilitate easy access to services or products.

Security is also paramount with Swish QR codes. They utilize encryption protocols that ensure safe transactions for both merchants and consumers alike.

Adopting this technology aligns businesses with modern payment trends. Embracing digital solutions signals innovation and adaptability to customers who appreciate convenience in their shopping experiences.

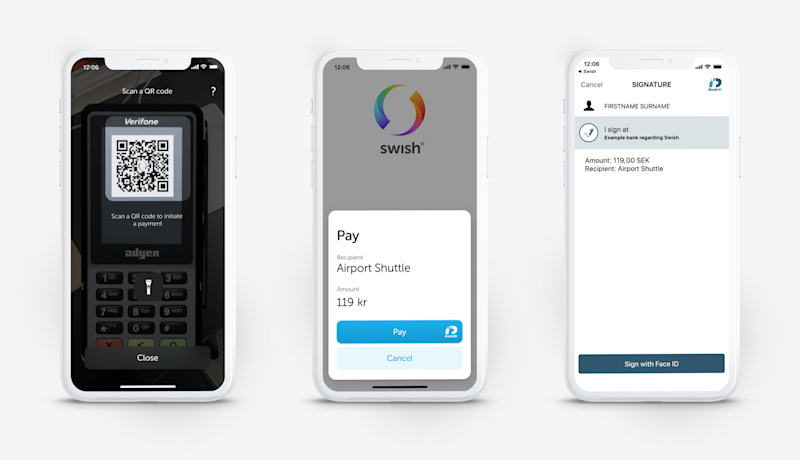

How to Create and Use a Swish QR Code

Creating a Swish QR Code is straightforward and user-friendly. Start by downloading the Swish app on your smartphone. Registration requires linking your bank account, ensuring secure transactions.

Next, navigate to the “QR code” section within the app. Here, you can generate a unique code that links directly to your payment information or invoice details. Customize it with logos or colors if desired for branding purposes.

Once created, save the QR code image to your device. You can now print it out or share it digitally across platforms like social media and websites.

To use the Swish QR Code, simply have customers scan it using their own devices. This allows them to complete payments swiftly without any hassle—making shopping smoother than ever before!

Examples of Businesses Successfully Implementing Swish QR Codes

Swish QR codes have gained traction among various businesses, revolutionizing how they manage payments and customer interactions.

Retail stores are leading the way. Many shops now display Swish QR codes at checkout counters. Customers simply scan the code to complete transactions quickly and securely.

Restaurants also leverage this technology. Diners can pay their bills seamlessly by scanning a Swish QR code on their table or receipt. This enhances convenience while reducing wait times for both staff and customers.

Event organizers have found innovative uses too. Concerts and festivals use Swish QR codes for ticket sales, enabling attendees to purchase entry on-the-go without needing cash or cards.

Even charities benefit from this approach. Fundraisers incorporate Swish QR codes into campaigns, making it easy for supporters to donate instantly via their smartphones.

These examples demonstrate how versatile and effective Swish QR codes can be across different sectors.

Potential Drawbacks and Limitations of Swish QR Codes

While Swish QR codes offer many advantages, they are not without limitations. One significant drawback is the reliance on smartphone technology. Users must have a compatible device and internet access to scan and utilize the code effectively.

Security concerns also arise with digital payments. If users aren’t cautious, they might fall victim to phishing scams or fraudulent links disguised as legitimate Swish QR codes.

Another limitation involves user familiarity. Not everyone understands how to use these codes, especially in older demographics who may feel overwhelmed by technology.

Businesses need to consider technical glitches. Issues like poor camera quality or low lighting can hinder scanning efficiency, leading to potential frustration for customers trying to make transactions quickly.

The Future of Swish QR Codes and Mobile Payment Technology

The future of Swish QR codes is poised for transformation as mobile payment technology evolves. With the rise of contactless transactions, these codes will play an integral role in streamlining payments.

As smartphone adoption grows globally, more consumers are comfortable with scanning QR codes. This convenience fosters a seamless shopping experience that many businesses can leverage.

Innovations like augmented reality could enhance how users interact with Swish QR codes, making payments even more engaging and intuitive. Additionally, integrating AI could personalize offers based on consumer behavior.

Security remains paramount. The development of advanced encryption methods will likely enhance user trust in mobile transactions using Swish QR codes.

Furthermore, collaborations between banks and tech companies may lead to broader acceptance across various platforms and retail environments. As this ecosystem matures, we can expect enhanced functionalities that cater to diverse customer needs while ensuring smooth operations for merchants.

Conclusion

The rise of Swish QR codes marks a significant step forward in the world of mobile payments. As we continue to embrace digital solutions, these codes provide convenience and efficiency for both consumers and businesses. The ability to quickly scan a code and make transactions on-the-go is transforming how we think about payment systems.

Businesses that adapt early can capitalize on this trend, gaining an edge over competitors who may be slower to adopt new technology. While there are some drawbacks, such as potential technical issues or user hesitation, the benefits generally outweigh the negatives.

With advancements in mobile payment technology and increasing consumer acceptance of digital currencies, Swish QR codes are likely here to stay. Their role will only become more significant as people seek faster and more secure ways to handle their finances.

As you explore integrating Swish QR codes into your business model or daily life, keep an eye on emerging trends that could further enhance their functionality. Embracing innovation today can set the stage for success tomorrow.