The spotlight in crypto used to shine on speculation. Now, it’s shifting toward something quieter – and more traditional. Institutional players are experimenting with real-world asset (RWA) yield models, using tokenized treasuries, bonds, and stablecoins to create predictable returns backed by tangible assets.

This shift is less about hype and more about infrastructure. The same technology that powered DeFi is now being repurposed to handle real cash flows, government securities, and interest-bearing tokens. It’s a pragmatic evolution – finance rediscovering blockchain, minus the noise.

Why the Shift Toward Yield-Backed Tokens

For years, DeFi’s main product was yield – except most of it came from speculation or liquidity mining. Institutions didn’t touch it. Now, with on-chain access to U.S. Treasuries and money market funds, yield is becoming real again.

Stablecoins like USDC or Tether have already proven that tokenized dollars can hold value and move across networks. The next step is yield-bearing versions – tokens backed by short-term government debt or commercial paper that pay actual interest.

It’s a logical progression. Treasury yields have hovered around 5%, and traditional custody banks are slow to modernize. Tokenized versions let investors move funds in minutes, not days, while still collecting predictable returns.

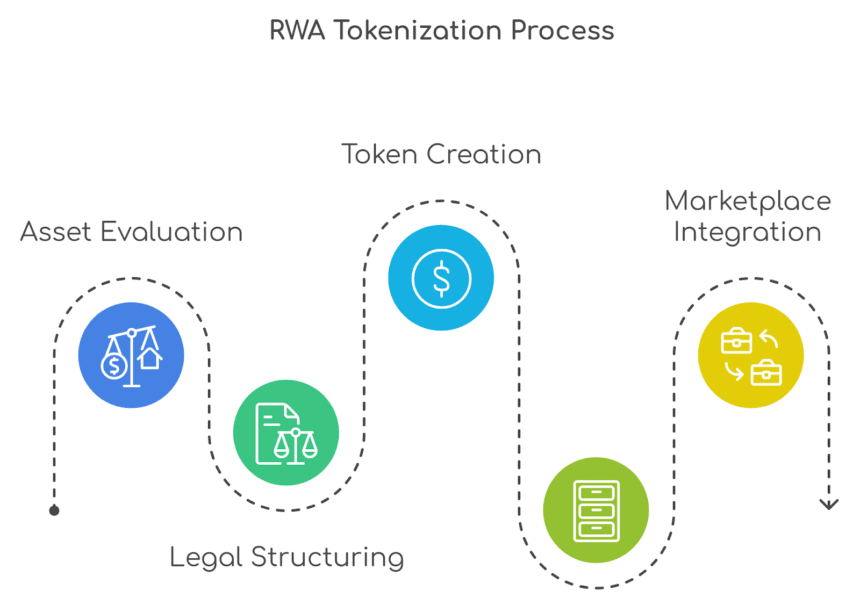

Platforms experimenting with RWA tokenization are the ones bridging these two worlds – combining regulatory-grade custody with programmable finance.

Treasuries Go On-Chain

Several pilots have shown what tokenized government debt can look like. Franklin Templeton’s “OnChain U.S. Government Money Fund” runs on Stellar and Polygon.

Ondo Finance tokenizes BlackRock’s short-term Treasury ETF under the ticker OUSG. Others, like Backed and Maple, are experimenting with institutional yield pools based on tokenized bonds.

Here’s how it works:

- Investors deposit stablecoins or fiat.

- A licensed entity buys Treasuries or bond ETFs.

- Tokens are minted 1:1 to represent underlying holdings.

- Smart contracts handle redemption, yield distribution, and reporting.

The process looks simple on the surface but involves deep integration between custodians, compliance rails, and blockchain oracles. This hybrid architecture mirrors what’s happening in fintech – where code handles the logic, and regulated institutions hold the keys.

Bonds Are Becoming Smart Contracts

Tokenized bonds take the idea one step further. Instead of tokenizing funds that hold bonds, the bond itself becomes a programmable asset.

Each token can represent a fractional claim to a bond’s cash flow, interest rate, or maturity. Smart contracts automate coupon payments, track ownership, and allow instant transfers between whitelisted investors.

This cuts settlement times from days to minutes and makes previously illiquid bonds tradable globally. But there’s a catch – every bond still has to obey securities laws. That’s why most pilots run under sandbox regimes or within permissioned networks.

The RWA tokenization trends already show this direction clearly: public blockchains for transparency, private sublayers for compliance, and token standards designed to meet ISO and SEC reporting formats.

It’s not DeFi anymore; it’s programmable TradFi.

The Role of Stablecoins in the Mix

Stablecoins might look boring next to tokenized bonds, but they’re still the glue holding RWA ecosystems together.

Every on-chain Treasury or yield-bearing bond needs a settlement asset – something stable enough for payments, redemptions, and interest payouts. Stablecoins fill that role perfectly.

They also act as liquidity bridges between DeFi and institutional finance. Investors can move in and out of tokenized assets using USDC or USDT without touching traditional banks. This liquidity layer makes the entire RWA model functional – tokenized debt doesn’t work if the cash flow can’t move fast.

Still, stablecoins face scrutiny. Regulators are debating their classification, and banks are exploring “tokenized deposits” as compliant alternatives. So, the line between stablecoin and digital cash is blurring quickly.

How Institutions Are Quietly Testing the Waters

Large institutions rarely make headlines with experiments. Most RWA pilots start small – a few accredited investors, one fund, and strict KYC. But the direction is clear: tokenized assets will enter balance sheets.

The appeal is simple:

- Real yield, not speculation.

- Faster settlement cycles.

- Lower custody costs.

- Auditable ownership trails.

Some asset managers are already building internal sandboxes for on-chain fund distribution. Others integrate blockchain rails into treasury management – swapping idle capital into tokenized money market instruments.

And while public announcements are rare, the activity behind the scenes is intense. It’s not about hype cycles anymore – it’s about regulatory-grade experiments.

The Compliance Layer Is the Real Innovation

Every tokenized Treasury or bond lives inside a compliance wrapper. Smart contracts handle access controls, KYC, and investor whitelisting. Custodians manage underlying securities. Oracles confirm price and settlement data.

It’s the same triad seen across RWA architecture – technology, regulation, and custody – now applied to yield-bearing instruments.

Firms like S-PRO, which work at the intersection of blockchain and financial infrastructure, help design these hybrid stacks so that institutional-grade tokenization actually works within legal frameworks.