Introduction to Pehp

Navigating the world of health insurance can feel overwhelming. With so many options available, it’s essential to find a plan that fits your needs and budget. One option gaining attention is Pehp, a unique program designed to offer tailored coverage for individuals and families. But is it the right choice for you? In this article, we’ll dive deep into what Pehp is all about, how it works, its pros and cons, and everything else you need to know before making an informed decision about your healthcare coverage. Whether you’re exploring new options or just curious about Pehp, we’ve got you covered!

What is Pehp?

Pehp, or Public Employees Health Program, is a health insurance option designed specifically for public employees. It aims to provide affordable and comprehensive healthcare coverage to those serving in various governmental roles.

This program offers a range of plans tailored to meet the diverse needs of its members. Whether you are a teacher, firefighter, or administrative staff member, Pehp seeks to ensure that quality care is within reach.

By pooling resources and negotiating with providers, Pehp strives to keep costs manageable for employees while maintaining high standards of service. The focus on preventive care further emphasizes wellness and promotes healthier lifestyles among participants.

Navigating the complexities of health insurance can be daunting. Pehp simplifies this process by offering straightforward choices that cater directly to public employees’ specific requirements.

How Does Pehp Work?

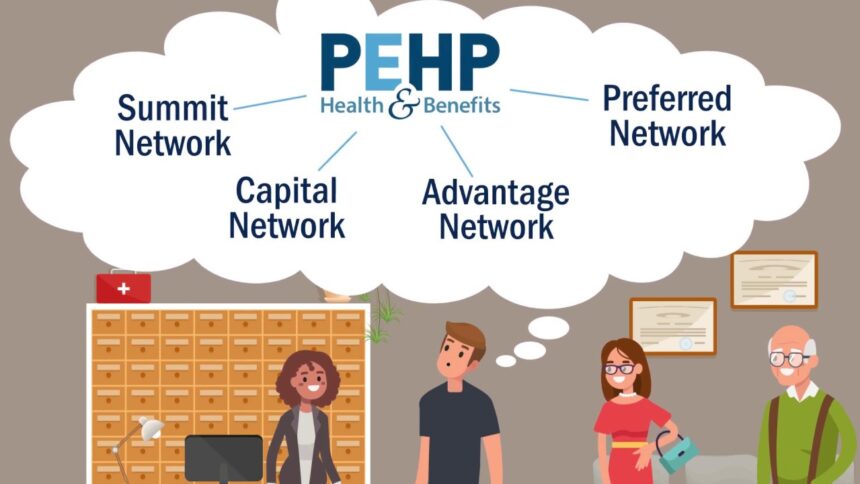

Pehp operates as a comprehensive health insurance plan designed to meet various medical needs. When you enroll, you’re essentially joining a network that includes doctors, hospitals, and specialists.

Once your coverage kicks in, you can access these healthcare services at negotiated rates. This means lower out-of-pocket costs for members when receiving care from providers within the Pehp network.

The plan also emphasizes preventive care. Regular check-ups and screenings are often covered fully without requiring a co-pay or deductible payment.

Members can manage their plans through an online portal. This platform allows users to track claims, find providers, and access benefits information easily.

In case of emergencies or unexpected health issues, Pehp provides peace of mind by ensuring swift access to necessary treatments while keeping expenses manageable for its members.

Pros and Cons of Choosing Pehp

Choosing Pehp comes with a variety of advantages. One of its main benefits is flexibility. Members can select from different plans tailored to suit their specific healthcare needs, allowing for personalized coverage.

Cost efficiency is another significant pro. Pehp typically offers competitive premiums compared to traditional health insurance options, making it an attractive choice for budget-conscious individuals and families.

However, there are some drawbacks worth considering. The network of providers may be limited, which could restrict access to certain specialists or facilities. Additionally, the initial enrollment process can be somewhat complex and time-consuming for newcomers.

Some users also report variability in customer service experiences. This inconsistency can lead to frustration when dealing with claims or inquiries about coverage details.

Understanding these pros and cons will help you make informed decisions regarding your healthcare options with Pehp.

Types of Coverage Offered by Pehp

PEHP offers a variety of coverage options tailored to meet diverse healthcare needs. One popular choice is the comprehensive medical plan, which covers hospital visits, preventive care, and specialist consultations.

For those looking for additional support, PEHP provides dental and vision plans as well. Routine check-ups and essential treatments are included in these packages, ensuring overall wellness.

Another option is the prescription drug coverage that helps manage medication costs. This feature plays a vital role in making necessary medications more affordable.

Additionally, PEHP includes mental health services as part of their offerings. Access to therapists and counseling can significantly impact overall health.

Whether you’re an individual or part of a family plan, understanding your specific needs will help you choose the right type of coverage within PEHP’s flexible options.

How to Enroll in Pehp

Enrolling in Pehp is a straightforward process that can set you on the path to better health coverage. Start by visiting the official Pehp website, where you’ll find all the essential information.

Once there, locate the enrollment section. It usually contains clear instructions and necessary forms. Make sure to have your personal details handy, such as Social Security numbers and income information.

If you’re an employee, check if your employer offers Pehp as part of their benefits package. They may have specific procedures for enrollment that you need to follow.

You’ll also want to pay attention to deadlines. Enrollment periods can vary based on whether you’re applying during open enrollment or qualifying for special circumstances.

Don’t hesitate to reach out directly for assistance if needed. Customer service representatives are available to guide you through any questions or concerns regarding your application process.

Alternatives to Pehp

When considering alternatives to Pehp, it’s essential to explore various options that cater to different needs. Many individuals lean towards traditional health insurance plans. These often offer broader networks and a variety of coverage levels.

Another alternative is Health Savings Accounts (HSAs). HSAs allow you to save money tax-free for medical expenses, providing flexibility with your healthcare spending.

Medicaid may be suitable for those who qualify based on income or disability status. It offers comprehensive coverage at little or no cost, depending on your situation.

Marketplace plans under the Affordable Care Act also deserve attention. They provide diverse options tailored to individual circumstances, ensuring access to necessary care without breaking the bank.

Consider short-term health insurance as a temporary solution while transitioning between jobs or waiting for other coverage options. Each choice has its pros and cons; it’s crucial to evaluate what fits best within your financial and healthcare needs.

Final Considerations and Conclusion

Choosing the right health plan is crucial for your well-being and financial stability. Pehp offers a variety of options that can fit different lifestyles and needs.

It’s essential to weigh your personal circumstances against what Pehp provides. Consider factors like coverage, costs, and potential out-of-pocket expenses. This assessment will help you decide if it aligns with your health priorities.

Remember to explore all available resources or speak with an advisor before making a decision. Each individual’s situation is unique, and understanding these nuances can lead to better choices.

It’s about finding peace of mind in your healthcare journey. The right plan should empower you rather than add stress. Take the time necessary to make informed decisions that serve you best long-term.

FAQ

Navigating health insurance options can be overwhelming, and PEHP might just be what you need. As a trusted provider in Utah, they offer a variety of plans designed to meet individual needs.

If you’re still pondering whether PEHP is the right choice for you or have lingering questions about their services, here are some frequently asked questions that may help clarify your doubts.

What types of plans does PEHP offer?

PEHP provides several plan options that cater to different needs, including HMO, PPO, and high-deductible health plans. Each option has distinct features tailored for unique situations.

Can I use my current doctor with PEHP?

Many providers participate in the PEHP network. It’s always advisable to check if your preferred healthcare professionals are included before enrolling.

How do I file a claim with PEHP?

Filing claims with PEHP typically involves submitting necessary forms along with any relevant medical documentation through their website or customer service tools.

Are there waiting periods for coverage under PEHP?

Waiting periods can vary based on the specific plan chosen and individual circumstances like prior coverage gaps. Always read the details carefully when reviewing policy information.

Is financial assistance available through PEHP?

Yes! Depending on eligibility factors such as income level or household size, individuals may qualify for additional support programs offered by this organization.

Choosing the right health insurance is essential for peace of mind and effective planning for future healthcare needs. Whether you opt for Pehp or consider other alternatives remains an important decision rooted in personal circumstances and preferences.