Are you ready to take control of your finances and pave the way towards financial freedom? Creating a budget plan is the key to achieving your financial goals and securing a stable future. In this blog post, we will guide you through the essential steps to create an effective budget plan that works for you. Let’s dive in and learn how to master the art of budgeting!

Understanding the Importance of a Budget Plan

Understanding the importance of a budget plan is crucial for anyone looking to take control of their financial well-being. A budget acts as a roadmap, guiding your spending habits and helping you make informed decisions about your money. Without a budget, it’s easy to lose track of where your money is going and end up in debt or living paycheck to paycheck.

A budget plan provides clarity on your financial situation, allowing you to see exactly how much money you have coming in and going out each month. By creating a budget, you can identify areas where you may be overspending and make adjustments accordingly. This awareness empowers you to prioritize your expenses based on what truly matters to you.

Moreover, having a budget plan encourages responsible financial behavior by promoting mindful spending and saving practices. It enables you to allocate funds towards savings goals, emergency funds, or investments for long-term growth. A well-thought-out budget plan sets the foundation for achieving financial stability and reaching your desired milestones.

Steps to Creating a Budget Plan

Understanding the Steps to Creating a Budget Plan is crucial in managing your finances effectively. The first step is to Assess Your Current Financial Status. This involves gathering all relevant information about your income, expenses, debts, and savings.

Next, Set Realistic Goals and Priorities based on your financial situation and future aspirations. Determine what you want to achieve with your budget plan, whether it’s saving for a big purchase or paying off debt.

Tracking Your Income and Expenses is essential for creating a realistic budget. Keep detailed records of all money coming in and going out each month to understand where your money is being spent.

Implement Strategies for Cutting Costs and Saving Money by identifying areas where you can reduce expenses without sacrificing essentials. This could involve meal planning, cutting back on subscriptions, or finding more affordable alternatives.

Adjusting and Revising Your Budget Plan regularly ensures that it remains effective as your financial circumstances change. Stay proactive in making necessary adjustments to reach your financial goals successfully.

Assessing Your Current Financial Status

Understanding where you stand financially is the crucial first step in creating a budget plan. Take a close look at your current income, including all sources like salary, investments, and any additional earnings. Next, assess your expenses meticulously – from monthly bills to discretionary spending on entertainment or dining out.

Consider any outstanding debts like student or credit card balances. Knowing how much you owe will help you prioritize debt repayment in your budget plan. Additionally, evaluate your savings and emergency fund situation – are they adequate for unexpected expenses?

Analyze your financial habits and identify areas where you may be overspending unnecessarily. Keep track of all transactions for a month to get a clear picture of where your money is going. This assessment will lay the foundation for setting realistic goals based on your actual financial circumstances.

Don’t forget to consider future financial goals such as saving for retirement or purchasing a home when evaluating your current status.

Setting Realistic Goals and Priorities

When it comes to setting realistic goals and priorities in your budget plan, it’s essential to align your financial objectives with what matters most to you. Start by identifying what you truly value and envision for your future. Whether it’s saving for a dream vacation, buying a home, or building an emergency fund, clarity on your priorities will guide your budgeting decisions.

Consider breaking down your long-term goals into smaller, achievable milestones. This approach can help you stay motivated and on track as you work towards larger financial aspirations. Remember that flexibility is key – life is unpredictable, so be prepared to adjust your goals as needed while staying focused on the bigger picture.

Prioritizing where your money goes based on what brings you the most satisfaction and fulfillment can lead to a more balanced and rewarding financial journey. By setting realistic expectations and making intentional choices with your finances, you’ll be better equipped to achieve success in reaching your desired outcomes.

Tracking Your Income and Expenses

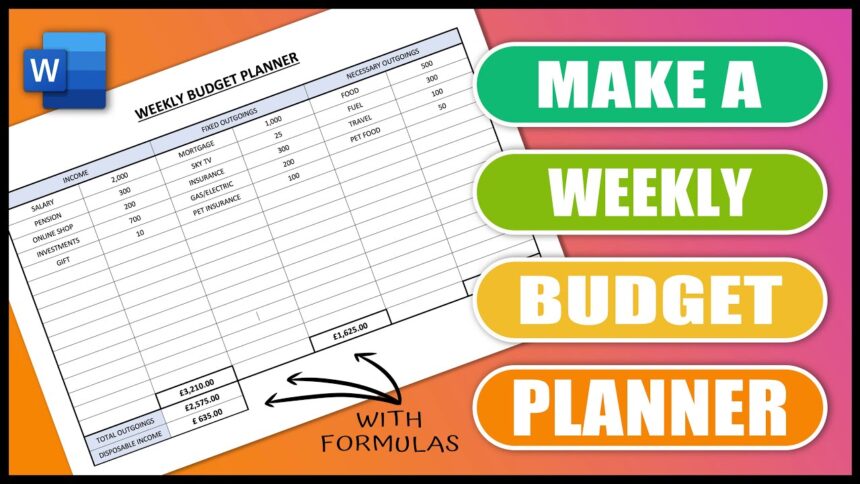

Tracking your income and expenses is a crucial aspect of creating an effective budget plan. It provides you with a clear picture of where your money is coming from and where it’s going. Start by gathering all your financial documents, including pay stubs, bank statements, bills, and receipts.

Create categories for your expenses such as groceries, utilities, rent or mortgage, transportation, entertainment, and savings. Utilize spreadsheets or budgeting apps to input these numbers accurately. Be diligent in recording every expense no matter how small – those daily coffee runs can add up quickly!

Regularly review your spending habits to identify areas where you may be overspending or where you can cut back. This process will help you make informed decisions on how to allocate your funds wisely moving forward. By tracking your income and expenses diligently, you’ll gain better control over your finances and have a clearer understanding of how to reach your financial goals.

Strategies for Cutting Costs and Saving Money

Looking for ways to cut costs and save money? One effective strategy is to review your monthly expenses meticulously. Look for areas where you can trim down unnecessary spending, like dining out frequently or subscribing to services you don’t fully utilize.

Another smart tactic is negotiating with service providers such as internet or cable companies for better deals. Sometimes a simple phone call can lead to significant savings. Additionally, consider shopping around for better insurance rates or refinancing high-interest to lower your monthly payments.

Creating a meal plan and cooking at home instead of eating out can also help you save big in the long run. Moreover, try opting for generic brands at the grocery store, buying items in bulk when on sale, and utilizing coupons whenever possible.

Challenge yourself to implement no-spend days or weeks where you only purchase essentials. This exercise can help you become more mindful of your spending habits and identify areas where you may be overspending without realizing it.

Adjusting and Revising Your Budget Plan

Adjusting and revising your budget plan is a crucial step in achieving financial stability. As life circumstances change, so should your budget to reflect those adjustments. Be flexible and open to making necessary changes to ensure your financial goals are met.

Regularly review your income and expenses to identify areas where you can cut costs or reallocate funds towards priorities. It’s okay if not every month goes according to plan; the key is adapting and staying on track in the long run.

Consider setting aside a specific time each month to evaluate your budget and make any needed revisions. This proactive approach will help you stay proactive in managing your finances effectively.

Remember, a budget plan is meant to be dynamic, not static. Embrace the process of adjusting and revising as part of your journey towards financial success.

Benefits of Having a Budget Plan

Budget plans offer a sense of control over finances, allowing individuals to make informed decisions about their money. By having a budget plan in place, you can prioritize your spending and allocate funds towards goals that matter most to you.

Having a clear budget helps to reduce financial stress and anxiety by providing a roadmap for managing expenses and saving for the future. It allows you to track where your money is going and identify areas where adjustments can be made to improve your financial health.

Budgeting also promotes accountability and discipline when it comes to spending habits. It encourages mindful consumption, helping you avoid unnecessary purchases and impulse buying that can derail your financial goals.

Moreover, with a budget plan, you can better prepare for unexpected expenses or emergencies by setting aside funds in advance. This proactive approach ensures that you have a safety net in place during challenging times.

The benefits of having a budget plan extend beyond just monetary gains; it fosters financial stability, empowers smart decision-making, and cultivates long-term wealth-building habits.

Conclusion

As you reach the end of this article, it’s important to reflect on the valuable insights gained about creating a budget plan. The journey towards financial stability and freedom begins with understanding your current situation, setting realistic goals, tracking expenses, and implementing strategies to save money.

Remember that creating a budget plan is not a one-time task but an ongoing process that requires regular assessment and adjustments. By continually revising your plan and making necessary changes, you can stay on track towards achieving your financial objectives.

The benefits of having a well-thought-out budget plan are numerous – from reducing financial stress to reaching your savings targets faster. So take charge of your finances today by crafting a personalized budget plan tailored to your needs and aspirations.

Stay motivated and committed to following through with your budget plan for long-term financial success!

FAQ

If you still have some questions about creating a budget plan, check out these frequently asked questions:

Q: How often should I review and adjust my budget plan?

A: It’s recommended to review your budget plan monthly to ensure it aligns with your current financial situation and goals.

Q: What if I overspend in a particular category?

A: If you find yourself overspending in a specific category, consider reallocating funds from other areas or finding ways to cut back on expenses.

Q: Is it necessary to stick strictly to my budget every month?

A: While it’s essential to try and adhere to your budget as much as possible, flexibility is key. Life happens, so be prepared to make adjustments when needed.

By following the steps outlined in this guide and staying committed to managing your finances effectively through a well-crafted budget plan, you can take control of your money and work towards achieving your financial goals. Remember that creating a budget plan is just the first step – consistent monitoring and adjustment are vital for long-term success. Start today and pave the way for a more secure financial future!