The UK Economy in Q1 2025: A Strong Short-Term Response

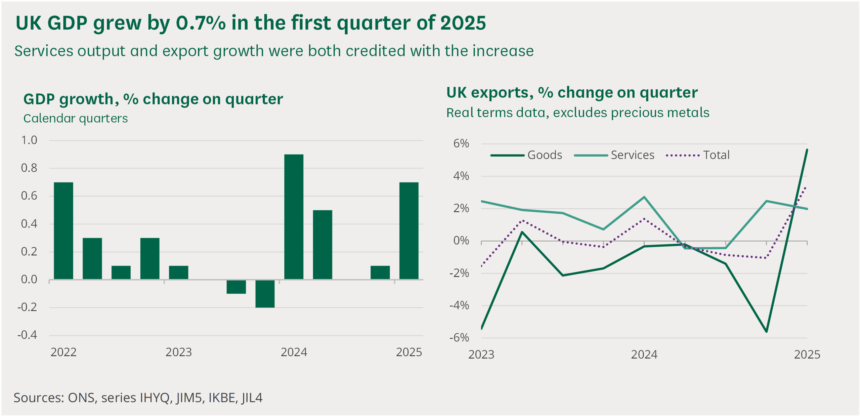

In the first quarter of 2025, the United Kingdom registered a GDP growth of 0.7%, placing itself ahead of several major advanced economies. France grew by just 0.1%, Germany by 0.4%, and the Eurozone as a whole managed a modest 0.3%. The United States, in a surprising turn, recorded a 0.1% contraction. These figures suggest that the UK, despite its post-Brexit trade realignments and ongoing cost-of-living pressures, is demonstrating a position of short-term resilience that contrasts with recession elsewhere.

Historically, the UK’s economic growth has often mirrored US trends due to deep fiscal and trade ties. The fact that the UK is now outperforming the US—albeit slightly—marks a significant reversal from patterns observed over the past two decades. The slowdown in the American economy is attributed to tighter monetary policies and the onset of fiscal belt-tightening, while Britain’s recent growth appears to be driven by a rebound in consumer spending and stabilisation in energy prices. Still, this short-term gain does not eliminate the longer-term structural challenges that remain.

A Patchy Recovery from the Pandemic: The Long View Since 2019

Since the final quarter of 2019, just before the COVID-19 pandemic wreaked havoc on the global economy, the UK economy has grown by a total of 4.1%. This places it behind the Eurozone average of 5.3% and significantly below the United States, which has seen a 12.1% expansion over the same period. Among G7 countries, the UK sits roughly in the middle, with Germany lagging far behind at just 0.3% total growth since the pandemic began. This data highlights the depth of Germany’s current economic malaise and the strength of the American economic model’s ability to rebound quickly after shocks.

The pandemic period marked a global economic turning point, and each country’s recovery reflects both policy choices and structural realities. The US implemented massive fiscal stimulus early on, creating a consumption boom that has yet to fully subside. The UK, by contrast, relied heavily on furlough schemes and Bank of England interventions but struggled with Brexit-related trade disruptions and labor shortages. While the worst may be over, the UK’s modest post-COVID growth underscores challenges in productivity and long-term investment.

Revised Forecasts from OECD and IMF Show Fragile Optimism

Global economic institutions remain cautious. In its June 2025 update, the OECD revised UK GDP growth for the year slightly downward—from 1.4% to 1.3%—and expects only 1.0% growth in 2026. Meanwhile, the International Monetary Fund (IMF) is even less optimistic, cutting its April forecast from 1.6% to 1.1% for 2025. Both organizations point to external shocks, including tariffs imposed by the United States and sluggish global demand, as major risks facing the UK economy. They also highlight persistent domestic issues such as weak business investment, lack of productivity gains, and tight monetary conditions.

Despite these downgrades, the UK is still expected to grow faster than France (0.6%), Germany (0.0%), and Italy (0.7%) in 2025. The only G7 countries projected to grow more quickly are the United States (1.8%) and Canada (1.4%). This environment matters because relative growth influences everything from currency strength to investor sentiment. For traders and market watchers, GDP forecasts are not just academic—they have real-world impacts on market volatility, capital flows, and central bank decisions. The Bank of England, facing mixed signals, may end its tightening cycle sooner than expected, which would have important implications for sterling and UK equities.

Trading Economic Performance with CFDs: A Way to Speculate on Macro Trends

For traders looking to capitalize on these macroeconomic shifts, Contracts for Difference (CFD meaning ) offer a flexible instrument to speculate on the future direction of markets driven by GDP trends. A CFD is a derivative that allows investors to go long or short on a wide range of assets—stocks, indices, commodities, or currencies—without owning the underlying asset.

For example, if UK GDP data is stronger than anticipated and suggests that the Bank of England might delay rate cuts, a trader might go long on the FTSE 100 index or the GBP/USD currency pair via CFDs. Conversely, disappointing data could prompt short positions, especially on domestically focused stocks or sterling pairs.

Using GDP data as a trading signal requires contextual understanding. For instance, better-than-expected growth might not always trigger bullish market responses if inflation prospects rise simultaneously. This is why many professional CFD traders monitor not only headline GDP numbers but also revisions, forward guidance, and comparative international figures. In 2025, as inflation dominates policy discussions and growth forecasts are constantly revised, CFDs remain one of the most accessible tools for those aiming to profit from global macroeconomic trends—particularly when traditional buy-and-hold strategies offer limited returns in sideways markets.