For crypto investors seeking a robust and efficient terminal that combines automation and manual controls, the cryptorobotics trading platform offers exactly that. Connected securely via trading-only API keys to major exchanges, it supports automated bots, smart order execution, signals, signal bots, and chart-based tools—designed to serve both novices and experienced traders with powerful insights and automation.

What is Cryptorobotics Trading Platform?

Cryptorobotics is a cloud-based trading terminal that interfaces with more than 14 centralized exchanges, including Binance (Spot & Futures), Binance.US, Bybit, KuCoin, OKX, Kraken, HTX, XT.COM, Bitfinex, Gate.io, Exmo, and MEXC. It also offers demo environments to explore strategy risk-free. By operating through trading-only API keys, users maintain full control over funds while enjoying advanced trading tools accessed from a consolidated platform.

Cryptorobotics — Crypto Trading Platform Features

- Automated Trading Bots

Designed for both spot and futures markets, these bots execute strategies such as trend-following, volatility trades, and portfolio rebalancing. They emphasize risk management and do not use high-risk methods like Martingale or grid bots. - Crypto Signals

Integrates real-time signals from trusted sources like AI Alpha, Kuresofa, and Cryptosegnali. Users can manually decide whether to enter, and the system will exit them automatically. - Signal Bots

Bots parse and evaluate incoming signal feeds in real time, executing trades when specific conditions—set by the user—are met. - Smart Ladder Orders

Allows traders to distribute orders across multiple price levels, assisting in smoother entry or exit during volatile or sideways market phases. - Smart Trading

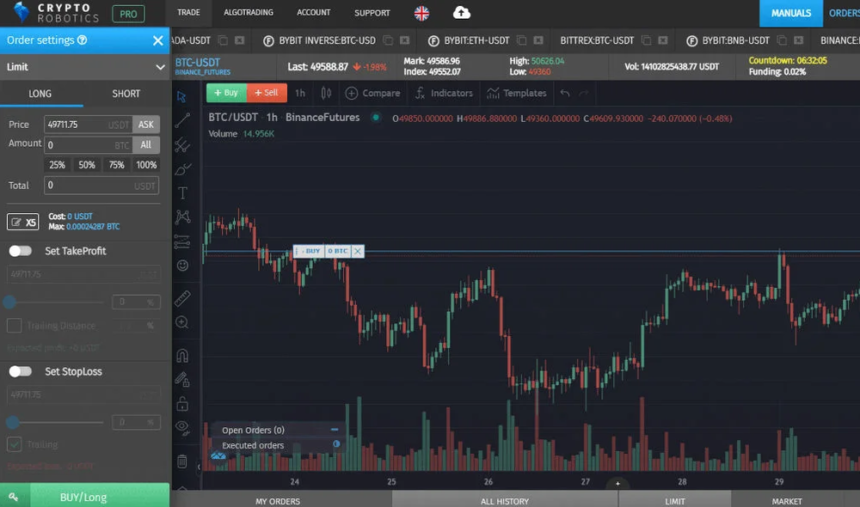

Built-in TradingView-style charts let users place Limit, Market, Stop-limit, and Smart orders directly from the chart interface, complete with custom technical indicators and templates. - Risk Management Tools

Includes built-in Stop-Loss, Take-Profit, and Trailing orders to protect positions and ensure disciplined execution, especially during automated strategies.

Cryptorobotics Interface

The platform offers a sleek, dark-themed UI that organizes exchange connections, bots, signals, order panels, charts, and analytics in a clear, modular layout. With drag-and-drop support and full responsiveness on desktop and mobile, it delivers an intuitive trading experience.

Supported Crypto Exchanges

Cryptorobotics supports both spot and futures trading on these major exchanges:

- Binance (Spot + Futures)

- Binance.US

- Bybit (Spot + Futures)

- KuCoin

- OKX

- Kraken

- HTX (Huobi)

- XT.COM

- Bitfinex

- Gate.io

- Exmo

- MEXC

Users also have access to demo environments for safe testing and strategy refinement.

Cryptorobotics — Tariffs & Plans

| Plan | Monthly Fee | Features Summary |

| Free | $0 | Access up to 10 stop-limit and 2 OCO orders, 14-day bot trials, and 30-day analytics dashboard. |

| Basic PRO | from $7 | Unlimited orders across exchanges, one custom bot, full analytics dashboard access. |

| Expert PRO | from $29 | Includes 11 pre-set bots (Optimus, Cyberbot, Crypto Future), one signal channel and signal bot access, smart order execution, and analytics dashboard. |

| Signals PRO | from $89 (discounted from $149) | 14 exchanges plus premium signal feeds (e.g., AI Alpha, Kuresofa, Cryptosegnali). |

| Profit‑Sharing | Pay-as-you-profit model | No fixed subscription—platform fee only when automated trades are profitable. |

Occasional promotions—such as 40% off PRO plans—are available through July 10.

Advantages & Disadvantages

Advantages

- Centralized access to over 14 exchanges from a single dashboard

- Powerful automation, signals, and copy trading features

- Advanced charting tools and smart order types for better execution

- Built-in risk management promotes disciplined trading

- Flexible pricing—free demo tier, low-cost PRO plans, and profit-sharing

- High customer satisfaction (~4.6/5 on Trustpilot)

Disadvantages

- Learning curve associated with extensive features

- Full access requires higher-tier subscription

- Profit-sharing model applies only to select bots

- No very aggressive strategies like Martingale or arbitrage bots

How to Start Using Crypto Trading Platform

- Visit cryptorobotics.ai and create an account.

- Connect your exchange(s) using secure, trading-only API keys.

- Select your plan: Free, Basic PRO, Expert PRO, Signals PRO, or Profit-Sharing.

- Choose your trading tools—bots, signals, signal bots, etc.

- Allocate capital (commonly ~10%), set risk rules, then launch.

- Monitor results on the Analytics dashboard, customizing settings or switching bots as needed.

Conclusion

Cryptorobotics offers a cohesive and powerful terminal for crypto trading, blending automation, manual control, advanced charting, and strategy replication across multiple exchanges. With affordable pricing—including a free tier and a profit-based fee model—plus strong risk management and high user satisfaction, it stands out as one of the top crypto trading platforms of 2025.