In today’s digital landscape, businesses face a multitude of security threats. Among them, RussianMarket CC dumps have emerged as a particularly insidious problem. These illicit activities not only compromise sensitive customer information but can also wreak havoc on an organization’s reputation and financial stability.

With cybercriminals becoming increasingly sophisticated, it’s crucial for businesses to stay informed and proactive. This blog will explore the nature of Russian-market.cc CC dumps and their growing prevalence in the cybercrime world. More importantly, we’ll provide actionable tips that can help safeguard your business from falling victim to these scams.

Whether you’re a small startup or a large corporation, understanding how to combat this threat is essential for maintaining trust with your customers and ensuring long-term success. Let’s dive into what you need to know!

What are RussianMarket CC Dumps and How Do They Work?

RussianMarket CC dumps refer to stolen credit card data that is bought and sold on underground marketplaces. These dumps typically contain sensitive information, including card numbers, expiration dates, and CVV codes.

Cybercriminals acquire this data through various methods such as hacking into databases or phishing attacks. Once they have the information, they package it for sale on platforms like RussianMarket.

The allure of these dumps lies in their potential for profit without much effort. Buyers can use the stolen data to make fraudulent purchases or sell it again at a markup.

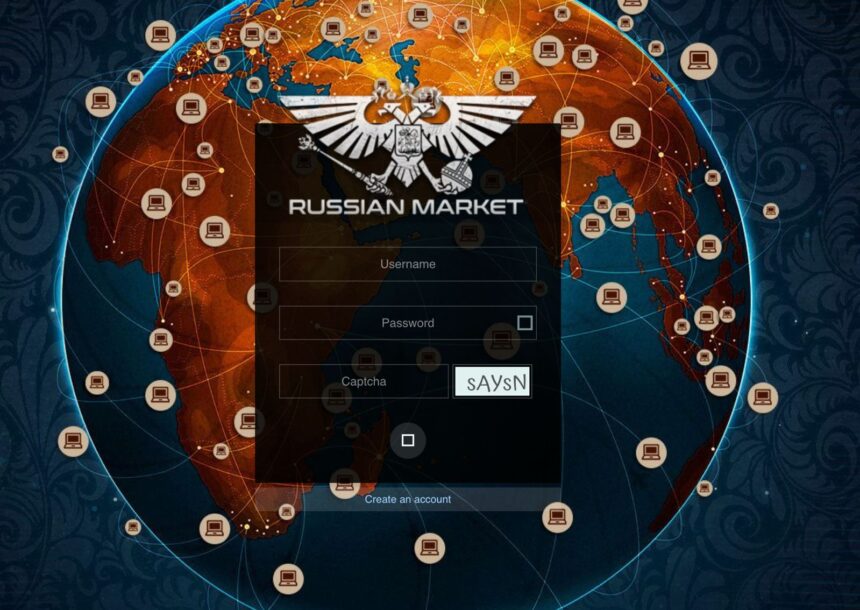

What makes RussianMarket particularly concerning is its anonymity features and encrypted transactions, which complicate law enforcement efforts. As more businesses rely on digital payments, understanding these threats becomes essential for protecting sensitive customer information.

The Growing Threat of RussianMarket CC Dumps

RussianMarket CC dumps have emerged as a significant concern for businesses worldwide. This underground marketplace specializes in the sale of stolen credit card information, often compromising sensitive customer data.

As digital transactions rise, so does the threat level. Cybercriminals leverage sophisticated techniques to harvest credit card details from unsuspecting users. Phishing, malware, and data breaches are common tactics used to collect valuable financial information.

The implications for businesses can be severe. Financial losses aren’t the only consequence; reputational damage often follows a breach of trust with customers. Companies face legal repercussions too, especially if they fail to protect personal data adequately.

With RussianMarket login facilitating these crimes, it’s imperative that organizations stay vigilant against potential threats. Understanding this growing peril is just the first step in safeguarding assets and maintaining consumer confidence amidst an ever-evolving cyber landscape.

Tips for Businesses to Avoid Falling Victim to RussianMarket CC Dumps

To safeguard against RussianMarket CC dumps, businesses should prioritize robust security measures. Start with strong password policies that require complex combinations and regular updates.

Implement two-factor authentication for all sensitive accounts. This adds an extra layer of protection, making unauthorized access more challenging.

Regularly conduct security audits to identify vulnerabilities within your systems. Investing in professional cybersecurity services can help pinpoint weaknesses you might have overlooked.

Educate staff on recognizing phishing attempts and social engineering tactics commonly used by cybercriminals targeting Russian-market.cc users.

Employ a secure payment processing system that complies with industry standards like PCI DSS. These protocols reduce the risk of data breaches associated with fraudulent activities.

Ensure software is regularly updated to patch known vulnerabilities. This simple practice can significantly lower your chances of falling victim to sophisticated attacks linked to RussianMarket CC dumps.

Educating Employees on RussianMarket Cybersecurity Best Practices

Employee education is crucial for safeguarding against RussianMarket threats. Regular training sessions can empower staff to recognize phishing attempts and social engineering tactics.

Interactive workshops can make learning engaging. Simulations of real-life scenarios help employees practice their responses. This hands-on approach reinforces knowledge and builds confidence.

Keep resources accessible. A centralized location for cybersecurity guidelines allows quick reference when needed. Encourage open communication about potential threats or suspicious activities.

Fostering a culture of vigilance creates collective responsibility among team members. Incorporating cybersecurity into onboarding processes ensures that new hires are aware from day one.

Utilize newsletters or bulletins to share updates on emerging risks associated with RussianMarket scams. Keeping the conversation ongoing helps maintain awareness and encourages proactive behavior across the organization.

Investing in Secure RussianMarket Payment Technologies

Investing in secure payment technologies is crucial for safeguarding businesses against the threats posed by RussianMarket to. These systems provide layers of protection, ensuring sensitive data remains encrypted and private.

Choosing a robust payment processor with advanced security features can significantly reduce vulnerabilities. Look for options that offer two-factor authentication and real-time fraud detection.

Implementing tokenization techniques also helps protect card information during transactions. This means actual card numbers are never stored or transmitted, minimizing exposure to potential breaches.

Additionally, staying updated with compliance standards such as PCI-DSS will enhance your security posture. Regular audits can help identify weaknesses before they become serious issues.

Consider integrating artificial intelligence tools that analyze transaction patterns in real-time for suspicious activity. Automation not only streamlines processes but fortifies defenses against cyber threats stemming from platforms like RussianMarket.

Regularly Monitoring and Updating RussianMarket Security Protocols

Regular monitoring and updating of security protocols is crucial for businesses facing threats from RussianMarket. Cybercriminals constantly evolve their tactics, so staying ahead requires vigilance.

Establish a routine schedule to review your security measures. This proactive approach ensures that any vulnerabilities are quickly identified and addressed.

Integration of automated tools can aid in this process. These technologies can provide real-time alerts about potential breaches, giving you an edge against attackers.

Don’t forget employee feedback during these updates. Those on the front lines often spot issues or inefficiencies that might go unnoticed by management.

Keep abreast of industry developments related to cybersecurity. New threats emerge regularly; being informed helps in adapting your protocols effectively.

Conclusion

The rise of RussianMarket CC dumps poses a significant threat to businesses worldwide. Understanding what they are and how they operate is crucial for anyone managing financial transactions online. With the sophistication of cybercriminals increasing, businesses must be proactive in their defense strategies.

Educating employees about cybersecurity best practices can significantly reduce risks associated with these threats. The more informed your team is, the better equipped they’ll be to identify suspicious activities or potential breaches. Regular training sessions should become a routine part of your business strategy.

Adopting secure payment technologies can also help shield your organization from falling victim to Russian-market.cc-related scams. Investing in reputable software solutions ensures that sensitive data remains protected throughout every transaction.

Additionally, monitoring and updating security protocols regularly is essential for adapting to evolving cyber threats. This vigilance not only protects customer information but also enhances overall trustworthiness among clients and partners.

By taking these measures seriously, businesses can fortify themselves against the dangers posed by RussianMarket CC dumps while fostering a culture of cybersecurity awareness among employees and stakeholders alike. Prioritizing security today will pave the way for a safer tomorrow.

Frequently asked Questions (FAQ’s)

1. What are RussianMarket CC dumps, and why are they a concern for businesses?

Answer: RussianMarket CC dumps are illegal sales of stolen credit card data, often obtained through hacking, skimming, or data breaches. These dumps are then sold on dark web marketplaces like RussianMarket. For businesses, these CC dumps are a major concern because they can lead to fraudulent transactions, chargebacks, financial losses, and damage to their reputation. Fraudulent activity using stolen card data can also lead to compliance issues, especially with regulations like PCI-DSS.

2. How can businesses identify and prevent fraudulent credit card transactions from Russian-market.cc dumps?

Answer: Businesses can use the following practices to identify and prevent fraudulent transactions:

- Advanced fraud detection tools: Implement machine learning algorithms and AI-driven fraud detection systems that monitor and analyze transaction patterns for unusual behavior (e.g., transactions from high-risk locations, high transaction volumes).

- Address Verification System (AVS) checks: Ensure that the billing address provided by the customer matches the one on file with the issuing bank.

- CVV verification: Always request and verify the CVV (Card Verification Value) to confirm that the person making the purchase has physical access to the card.

- 3D Secure (3DS): Implementing 3D Secure authentication (e.g., Verified by Visa or Mastercard SecureCode) to add an extra layer of security during online transactions.

3. How can businesses protect customer data to prevent it from being stolen and sold on marketplaces like RussianMarket?

Answer: Businesses can protect customer data by:

- Encrypting sensitive information: Use strong encryption protocols (e.g., SSL/TLS) to protect sensitive data during transmission and storage.

- Tokenization: Replace sensitive card information with randomly generated tokens, making it useless if breached.

- Compliance with PCI-DSS: Adhere to Payment Card Industry Data Security Standards (PCI-DSS) to ensure that credit card data is stored, processed, and transmitted securely.

- Regular security audits: Conduct periodic security assessments, penetration tests, and vulnerability scans to identify weaknesses and address them promptly.

4. What security measures can businesses adopt to prevent skimming attacks that lead to CC dumps?

Answer: Businesses can adopt the following security measures to prevent skimming attacks:

- Use tamper-evident hardware: Install tamper-evident seals on point-of-sale (POS) terminals to detect physical tampering.

- Regularly inspect POS devices: Conduct routine inspections of in-store POS terminals for signs of skimming devices.

- Monitor for unusual behavior: Implement monitoring tools to detect unusual access patterns or network traffic that could indicate the presence of skimming malware.

- Educate employees: Train staff to recognize signs of skimming and to report any suspicious activity around POS devices.

5. How can businesses verify the authenticity of credit card information during online transactions?

Answer: Businesses can verify the authenticity of credit card information through:

- 3D Secure: Implement 3D Secure authentication to add an extra layer of validation by requiring customers to authenticate themselves with a password or one-time code during the transaction.

- Real-time fraud detection: Utilize fraud prevention tools that assess the risk level of transactions in real time, looking for patterns that match known fraudulent activities (e.g., multiple high-value purchases from the same IP address).

- Device fingerprinting: Track the device used for the transaction and cross-check it with previous transactions to ensure consistency.

- Geolocation checks: Monitor the geographical location of the purchase to see if it aligns with the customer’s past purchase behavior.

6. What is tokenization, and how does it help businesses protect credit card data?

Answer: Tokenization is the process of replacing sensitive credit card data with a unique, randomly generated identifier called a “token.” The token has no intrinsic value and cannot be reverse-engineered to obtain the original credit card data. This helps businesses protect cardholder information by storing only the token in their systems, minimizing the risk of a data breach. If hackers gain access to the system, they would only obtain useless tokens, not actual credit card information.

7. What are the best ways to ensure compliance with PCI-DSS and avoid RussianMarket CC dumps?

Answer: Businesses can ensure compliance with PCI-DSS by:

- Adhering to security standards: Follow all 12 PCI-DSS requirements, including protecting cardholder data, maintaining a secure network, and regularly testing security systems.

- Using strong encryption: Encrypt cardholder data both in transit and at rest to prevent unauthorized access.

- Monitoring access: Implement access control mechanisms to limit who can access cardholder data and regularly audit user activities.

- Training employees: Educate employees on best practices for handling sensitive payment data and recognizing security threats.

8. How can businesses handle chargebacks and disputes caused by fraudulent transactions from CC dumps?

Answer: To effectively handle chargebacks and disputes:

- Maintain detailed records: Keep thorough records of all transactions, including customer communication, shipping information, and IP addresses to provide evidence in case of a chargeback.

- Implement a chargeback management system: Use automated systems that can flag chargebacks early and help manage disputes in real time.

- Review and address fraud patterns: Regularly analyze chargeback data to identify recurring fraud patterns and adjust fraud prevention measures accordingly.

- Collaborate with payment processors: Work closely with payment processors to monitor and challenge fraudulent chargebacks, and implement measures to prevent future fraud.

9. How can businesses collaborate with payment processors and banks to prevent CC dump fraud?

Answer: Businesses can collaborate with payment processors and banks in the following ways:

- Share fraud data: Work with payment processors and banks to share fraud data and trends in real time, enabling proactive measures to prevent fraud.

- Use secure payment gateways: Ensure that payment gateways used by the business are PCI-compliant and use secure protocols like SSL/TLS.

- Implement fraud prevention tools: Payment processors often offer fraud prevention tools, such as transaction monitoring, AVS checks, and 3D Secure, which can help detect and prevent fraudulent transactions.

- Stay informed about emerging threats: Collaborate with financial partners to stay up to date with new fraud tactics and adapt security strategies accordingly.

10. What is the role of employee training in preventing fraud from RussianMarket CC dumps?

Answer: Employee training is crucial in preventing fraud because employees are often the first line of defense against fraudulent activity. Effective training should include:

- Recognizing phishing attempts: Educate staff on how to recognize phishing emails or scams that might be used to obtain sensitive information.

- Handling payment data securely: Ensure employees understand how to securely process and store payment information according to PCI-DSS guidelines.

- Spotting suspicious activity: Teach employees to identify unusual transaction patterns, such as multiple transactions in a short period, high-value transactions, or payments from geographically inconsistent locations.

- Reporting security breaches: Foster a culture where employees know how to report any potential security threats promptly and without fear of retribution.