Some come for the surf. Others, for the sunsets. But a growing number arrive in Bali with a suitcase in one hand and a spreadsheet in the other. At Bali.RealEstate, this dichotomy—between escape and enterprise—unfolds in vivid color. As vacationers morph into property hunters and investors sip coconuts while calculating ROI, one truth becomes clear: Bali isn’t just a destination. It’s a decision.

Where Tourism Fuels Real Estate—and Vice Versa

Let’s rewind. In 2024, Bali welcomed over 6.3 million international visitors—a staggering surge that didn’t just beat expectations but obliterated them. Planes landed, scooters revved, and suddenly, rental calendars filled faster than the tide came in. And behind that momentum? A quietly booming property market, stretching from rice fields to beach clubs.

Digital nomads, remote entrepreneurs, part-time philosophers—call them what you will—flocked to Bali’s shores, lured by its intoxicating mix of lifestyle and low living costs. The result? Demand exploded for flats and apartments with modern comforts and good Wi-Fi. Think open-concept kitchens, ergonomic chairs, infinity pools. Rental yields climbed. So did property prices.

Villas, the crown jewel of the island’s real estate offering, became the go-to investment. Gross returns? Anywhere from 7% to 15% annually. And not just in the busy districts—outlying areas started to shimmer with possibility too. Meanwhile, official stats showed Bali house prices for property investors nudging upward again: Q1 2025 brought a 0.5% year-on-year rise—the first in years.

Real Estate by Region: Numbers That Tell a Story

| Location | Median Price (USD) | Avg. Price per sqm (USD) | Avg. Rental Yield (%) |

|---|---|---|---|

| Canggu & Berawa | $355,000 | $2,578 | 7.96 |

| Seminyak | $400,735 | $3,122 | 9.24 |

| Ubud | $340,455 | $1,772 | 4.27 |

| Bukit Peninsula | $250,000 | $1,883 | 9.67 |

| Tumbak Bayuh | $226,995 | $1,710 | 14.55 |

Every District a Mood, Every Property a Story

Canggu & Berawa hum with youthful energy. Surfboards lean against café walls, while villas sparkle behind jungle-fringed walls. Here, property is less about bricks and more about buzz—digital nomad capital with nearly 8% yields.

Seminyak is polished, curated, and unapologetically upscale. Designer boutiques, curated cocktail menus, and villas pushing past the $400K mark. But it pays back—the highest price per square meter, and yields that top 9%.

Ubud is where the soul goes to exhale. Think meditation bells at dawn and verdant rice terraces beyond your veranda. Properties here cost less per meter, but so do the returns—just over 4%. Peace comes at a price.

Bukit Peninsula feels like the edge of the world. Cliffside infinity pools, secret beaches, whisper-quiet neighborhoods. The numbers are compelling: high nines in yield, mid-twos in price. A balance of serenity and return.

Tumbak Bayuh? Once a whisper, now a roar. The dark horse of the list, offering double-digit returns—14.55%, to be precise—and prices still under $230K. The savvy are already circling.

Investment Currents and Cultural Undercurrents

Work Meets Waves: The Rise of the Remote Villa

Call them “workationers” or just realists—remote workers are no longer settling for subpar spaces. They want villas with strong Wi-Fi, weekly cleaning, and a pool they can dip into between Zoom calls. And they’re willing to pay. These furnished month-to-month havens now dominate the short-term market.

Beyond the Obvious: Betting on the Next Hotspot

If you’re looking to leap before the crowd, keep an eye on Pererenan, Munggu, and Balangan. These neighborhoods, once overlooked, are sprouting with promise. With projected growth rates reaching 12% annually, they whisper of opportunity. New roads are being paved, cafes opening weekly, and developers drawing bold lines on empty plots.

The Luxe Surge

Luxury is no longer optional for the elite traveler—it’s expected. In just one year, the average villa price jumped 50%, catapulting from $321,000 to $484,000. Buyers in Berawa and Pererenan, in particular, are driving this boom. Privacy sells. So does silence.

The Fine Print: Bureaucracy in Paradise

Owning in Bali requires more than enthusiasm. Foreigners can’t technically own freehold land outright—most opt for long-term leaseholds, typically 25 to 30 years. Others set up Indonesian companies (PT PMA) to acquire full rights.

And don’t expect gentle interest rates. Local mortgages hover above 15%, with hefty down payments and legal fees stacked on top. Due diligence is essential: confirm zoning, inspect title deeds, and review building permits—especially for coastal or greenbelt plots.

The process, roughly, unfolds like this:

- Clarify Your Vision – Rental income, personal retreat, or full-time home? Your goal determines the play.

- Find Trusted Local Guides – Agents and legal experts who speak both the language and the laws.

- Verify Everything – Ownership documents, land use classifications, environmental restrictions.

- Choose Your Structure – Leasehold vs PT PMA. There’s no one-size-fits-all.

- Close, Then Manage – Once signed and sealed, consider a local property manager to handle rentals and maintenance.

Villas, Houses, and Flats: A Mix of Modern and Mythic

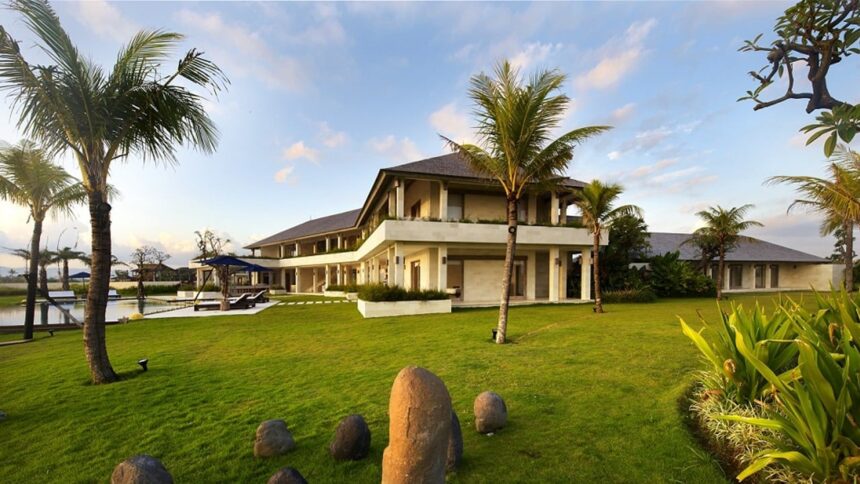

Villas are the heart of Bali’s real estate scene. From intimate two-bedroom hideaways to cliff-top compounds, they offer returns that can reach 12% or more. Ocean views? Expect bidding wars.

Houses speak to long-termers. Whether it’s a traditional compound shaded by banyans or a Scandinavian-inspired bungalow, prices range from $125K to half a million, depending on the vibe and the postcode.

Flats and apartments are the urban newcomer’s friend. Low maintenance, centrally located, and often within walking distance of nightlife. Some developments even come with co-working lounges. Prices start at $130K and rise with the view.

One Investor’s Leap of Faith in Tumbak Bayuh

In early 2024, an investor purchased a modest three-bedroom villa for $230,000 in Tumbak Bayuh. With strategic listings on global platforms, they hit 68% annual occupancy and pulled in an 11.5% rental return. Property value also ticked up 9%. Altogether? A 20%+ ROI in a single year. Not bad for a “quiet” village.

More Than a Market—It’s a Mood

Let’s not forget what makes Bali… Bali. A home here means more than ROI charts and tax strategies. It’s incense curling through morning air. Gamelan echoing across water temples. Kids flying kites over terraced fields. Even high-tech homes wear touches of tradition—carved wood gates, alang-alang roofs, open-air living rooms with jungle creeping in.

Final Thoughts: Where Passion Meets Portfolio

Bali seduces. But it also rewards. The island offers more than real estate; it offers reinvention. A beachfront bungalow doubling as a passive income stream. A jungle home that pays for itself through guest stays. An apartment you use three months a year—and rent out for nine.

Whether you’re seeking spiritual calm, financial upside, or simply a better backdrop for your emails, Bali’s property market is ready. Not perfect, not effortless—but rich in potential. And that, sometimes, is exactly enough.

Ready to dive in? The waves are warm—and the margins aren’t bad either.