Managing money in today’s economy is no easy task. With rising living costs, fluctuating interest rates, and more complex financial decisions than ever before, UK workers and families need reliable ways to stay on top of their finances. From buying a first home to planning for retirement, the numbers can quickly get overwhelming. That’s where Finance calculators step in.

These online tools take the guesswork out of everything from mortgage repayments to pension contributions, giving you accurate figures in just a few clicks. Instead of spending hours crunching numbers, you can see clear results tailored to your situation. In this article, we’ll highlight the Top 10 UK Finance Calculators Everyone Should Use in 2025. Whether you’re saving, borrowing, or investing, these tools will help you make smarter financial decisions and stay prepared for the year ahead.

Why Use UK Finance Calculators?

Financial decisions often come with a mix of uncertainty and complexity. Should you buy a home now or wait another year? How much will a personal loan really cost you in the long run? Are you saving enough to retire comfortably? These are the kinds of questions that can feel overwhelming without reliable guidance. This is where UK Finance calculators prove invaluable. They transform complicated financial formulas into quick, understandable results, tailored to your personal circumstances.

Instead of relying on rough guesses, you can instantly see how different variables, like interest rates, repayment terms, or savings contributions, affect your outcomes. The real power of these tools lies in their ability to support better decision-making. By testing different scenarios, you can compare options side by side, avoid costly mistakes, and create a clearer financial plan. Whether it’s for day-to-day budgeting or long-term planning, these calculators help you take control of your money with confidence.

Top 10 UK Finance Calculators

With so many financial products available, it’s easy to feel lost in the numbers. That’s why these ten tools stand out; they’re reliable, easy to use, and designed to make everyday financial decisions simpler. From mortgages to pensions, these UK Finance calculators cover the most common money challenges UK households face.

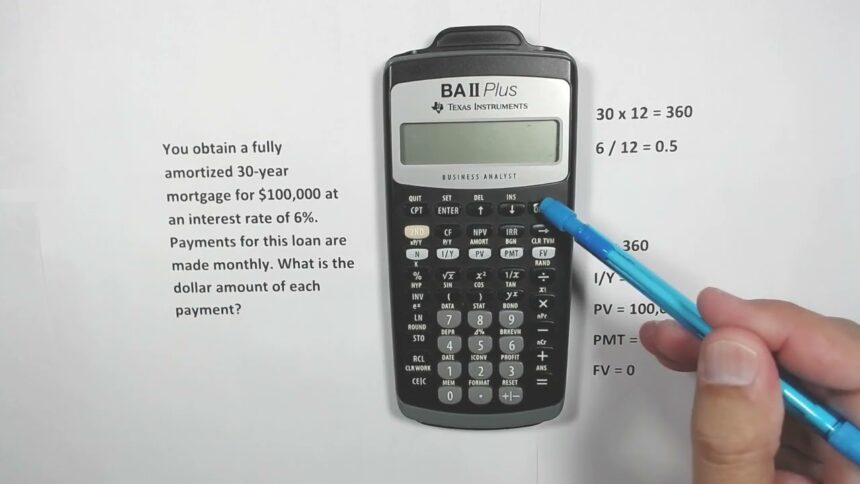

Mortgage Calculator UK

Buying a home is one of the biggest financial commitments you’ll ever make. A mortgage calculator UK helps you estimate monthly repayments, interest costs, and overall affordability based on property price, deposit, and term length.

Loan Repayment Calculator

Taking out a personal loan? A loan repayment calculator shows you exactly what your monthly instalments will look like and how much interest you’ll pay over the life of the loan.

Income Tax Calculator UK

Tax codes, allowances, and deductions can get complicated. An income tax calculator UK breaks down your gross vs net pay, factoring in PAYE, NI contributions, and pension deductions.

Pension Calculator UK

Retirement planning is easier with a pension calculator UK. This tool projects your future income based on contributions, expected growth, and retirement age.

Savings Calculator

Want to see how fast your money can grow? A savings calculator shows the impact of regular deposits and interest over time. Among the most-used UK Finance calculators, it’s perfect for short- and long-term goals.

Investment Calculator

If you’re investing in stocks or funds, this calculator estimates returns, compounding, and how different growth rates affect your portfolio.

Credit Card Repayment Calculator

Carrying a balance on your credit card? This tool shows how long it will take to pay off your debt, and how much interest you’ll pay, depending on your payments.

Budget Calculator

A simple but powerful tool, a budget calculator compares income and expenses, helping you spot overspending and allocate money more effectively.

NHS Pay Calculator UK

Whether you’re on Band 3 or Band 8a, an NHS pay calculator UK estimates your gross salary, net take-home pay after tax, National Insurance, and pension deductions—giving you a clear picture of your monthly and yearly income.

Stamp Duty Calculator UK

Buying property in England or Northern Ireland? This calculator shows how much Stamp Duty Land Tax you’ll owe, factoring in property value and first-time buyer relief.

Comparing Results Across Different Tools

If you’ve ever tried two different calculators for the same question, you may have noticed the numbers don’t always match. This isn’t an error; it’s simply because each tool applies its own assumptions. For example, one mortgage calculator may assume a 25-year term while another defaults to 30 years. Tax calculators may use slightly different allowances or rounding rules. Even savings calculators can vary depending on whether they use simple interest or compounding.

That’s why it’s smart to cross-check. If you’re planning a major purchase like a home or car, try at least two or three UK Finance calculators and compare the outputs. The goal isn’t to find one “perfect” number but to understand the range of possible outcomes. By spotting patterns across different tools, you’ll see the most realistic picture of your finances and avoid surprises later. A little comparison now can save a lot of stress down the road.

Tips for Using UK Finance Calculators Effectively

Finance calculators are only as useful as the information you provide, so accuracy matters. Always start by entering realistic figures, your actual income, expenses, deposit amounts, or savings contributions. Guessing or rounding up too much will distort the results.

It’s also worth experimenting with different scenarios. For example, increase your mortgage term from 20 to 25 years, or adjust your pension contributions by 5%. These “what-if” tests help you see how small changes can have a big long-term impact.

Another tip is to combine tools. Use a mortgage calculator alongside an income tax calculator UK, or pair a loan repayment tool with a budget calculator to see the full picture. And finally, don’t rely on one site alone. Checking two or three UK Finance calculators gives you more confidence that the results are accurate and consistent.

Conclusion

Financial planning can feel overwhelming, but the right tools make it far more manageable. From mortgages and loans to savings and pensions, online calculators provide quick, reliable insights that help you make smarter decisions. Instead of guessing or relying on rough estimates, you can instantly see how your choices affect your budget, long-term goals, and overall financial health.

The ten tools we’ve covered highlight just how versatile and practical these resources can be. Each one serves a different purpose, yet together they give you a complete picture of your money. The key is to use them consistently, test different scenarios, and cross-check results when needed. In 2025, making the most of UK Finance calculators isn’t just convenient, it’s essential for anyone who wants to stay financially secure and confidently plan for the future.