Black Friday is four weeks out. Your bestseller is surging on social, your U.S. customers are asking for earlier delivery, and the batch you sent by sea is still somewhere in the Pacific. Do you wait—and risk missing the wave—or do you pay more to fly a replenishment lot so shelves don’t go empty?

Importers face that trade-off every day. Air isn’t the cheapest way to move freight, but when speed, predictability, and customer expectations matter, it’s often the smarter choice. This guide is written from a buyer’s point of view. You’ll find practical decision rules, real-world pitfalls to avoid, and a simple checklist you can use before you book your next shipment.

When Air Freight Makes Business Sense

Speed protects revenue. Sea lead times of 30–40 days (plus drayage, appointments, and the usual snags) can turn a hot product cold. Air compresses the cycle to a week or so door-to-door on common lanes, which helps you launch on time, recover from stockouts, and keep velocity high.

Less handling, lower risk. Shorter transit means fewer touchpoints, fewer chances for moisture damage, pilferage, or carton collapse. For fragile or high-value cargo, that risk delta alone can justify air.

Better cash rotation. Frequent, smaller flights let you buy closer to demand and avoid tying up capital in 60–90 days of pipeline inventory. That flexibility matters when forecasts are noisy.

For importers weighing whether to use air, ocean, or a mix of both, it helps to step back and compare the full range of China to USA shipping options—cost, lead times, and service levels. Want a clear, non-technical overview you can share with your team? Check our complete guide to China–USA shipping.

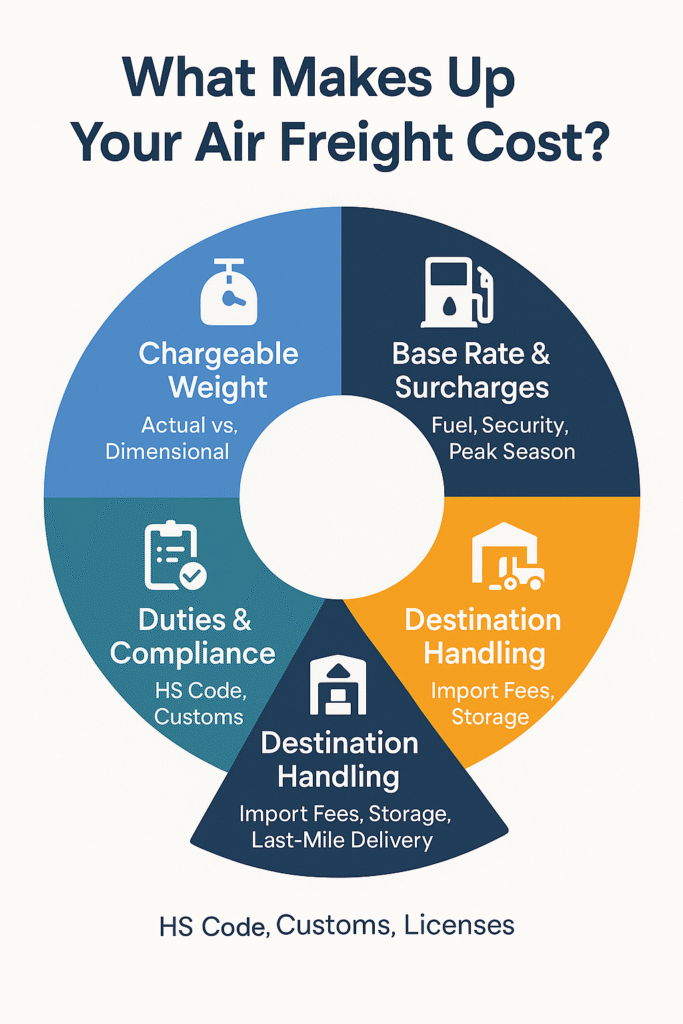

The Cost Anatomy (and How to Read a Quote)

Air feels expensive until you unpack where the money goes—and where surprises hide.

Chargeable weight. Airlines bill the higher of actual weight vs. volumetric weight. Volumetric (a.k.a. “dim”) weight is typically:

Length (cm) × Width (cm) × Height (cm) ÷ 6000

A 60×40×40 cm carton weighs 18 kg on a scale but counts as 16 kg dim; you pay on 18 kg. A light but bulky pillow may weigh 2 kg yet rate at 8 kg. Design packaging to cut “air” out of the box.

Base rate + surcharges. You’ll see a per-kg base plus fuel/security surcharges. Around peak periods, carriers and handlers may add seasonal fees. Always ask for the all-in figure to your final delivery address.

Origin & destination handling. Export screening, terminal fees, import handling, temporary storage, final-mile delivery—these add meaningful dollars, especially if the shipment sits due to paperwork issues.

Duties and compliance. Not a freight cost, but it hits landed margin. HS code accuracy, partner government agency (PGA) rules, and origin rules can add time and money if mishandled.

If you want a deeper dive into how quotes are built—and how to balance speed against margin—this guide to air freight from China to USA breaks down the key service levels and cost drivers in detail.

Mini case (simplified):

500 kg of bulky apparel: Air may still make sense for a “lifeline” top-up (e.g., 20% by air to bridge demand), with the balance on ocean.

100 kg of compact electronics: Air is often a smart play—margin per kilo dwarfs freight, delivery speed prevents stockouts, and damage risk is lower.

Transit Time: The Real-World Timeline

“Air is one day” only covers the flight. Your customer cares about door-to-door.

Typical flow: factory pickup → origin terminal handoff & screening → export clearance → flight (direct or via hub) → import clearance → local delivery.

Direct vs. transshipment.

- Direct (e.g., PVG/SZX → LAX/JFK/ORD): fastest and cleanest. With booked capacity and tidy docs, 5–7 days door-to-door is very achievable.

- Via hub (e.g., HKG/ICN/NRT/DOH): more space options and sometimes better pricing, but add 1–3 days.

What moves the needle:

- Docs right the first time (commercial invoice, packing list, correct HS, licenses if applicable).

- Capacity reserved before peak weeks.

- Delivery target (DC with easy access vs. FBA appointment windows that can add a day or two).

A helpful planning trick: build your plan on a median timeline (not the “best day ever”) and keep a small expedite budget for exceptions.

What to Fly—and What Not To

A clean way to decide is to compare value per kilogram to freight per kilogram, then layer in time sensitivity and risk.

Good air candidates

- High value, small form factor: consumer electronics, watches, medical devices, components.

- Seasonal/launch-critical: fast fashion capsules, promotional kits, limited drops.

- Quality-sensitive: items that don’t like long, humid ocean transits (certain cosmetics, nutraceuticals, specialty foods).

- Samples & urgent parts: when a production line or a big PO hinges on a part arriving this week.

Poor air candidates

- Low value, high cube: pillows, plasticware, low-margin toys.

- Oversize/heavy machinery: the economics break quickly.

- Restricted classes: lithium batteries, liquids, hazmat—possible, but complex and costly; many shippers are better served via specialized programs or ocean.

Rule of thumb: if your incremental gross margin saved by arriving 20–30 days earlier (avoided stockouts, earlier cash, pricing power) exceeds the air premium, you’re probably making the right call.

Pitfalls That Burn Budgets (and How to Avoid Them)

Lowball quotes that balloon later.

Symptom: “$X/kg to airport!” Then destination handling, storage, and delivery double your landed cost.

Fix: Ask for door-to-door all-in, with a written fee table for origin, destination, and any peak/war risk surcharges. Compare like-for-like.

Incoterms confusion.

Symptom: Supplier quotes DDP, you assume “everything included,” but the forwarder expects you to handle import compliance.

Fix: Align on Incoterms (EXW/FOB/CIF/DDP) and who performs export filing, import entry, and final delivery. Write it down.

Documentation mismatches.

Symptom: Commercial invoice values don’t match payment docs; HS is off by a digit; PGA rules (e.g., FDA) ignored.

Fix: Pre-clear docs with your forwarder. Ask them to sanity-check HS, declared values, and any agency requirements before pickup.

Volumetric surprises.

Symptom: Freight is 3× what you expected because cartons are mostly air.

Fix: Re-engineer packaging. Use right-sized boxes, compressible fillers, and master cartons that hit airline dimension sweet spots.

FBA/retailer delivery friction.

Symptom: Missed appointments, re-delivery charges, detention.

Fix: Book delivery windows early, label per spec, and pick a forwarder fluent in retailer routing guides.

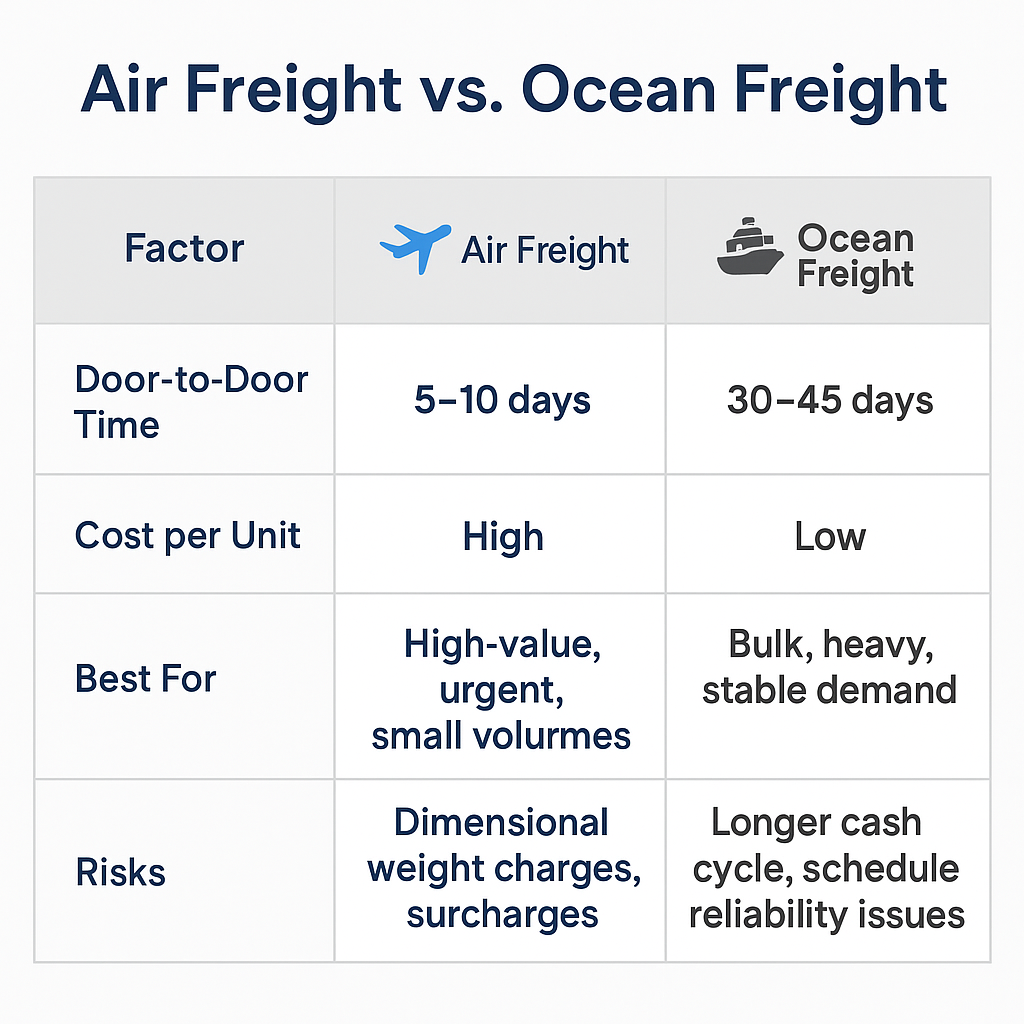

Air vs. Ocean vs. Express: A Quick Lens

| Mode | Typical Door-to-Door | Cost per Unit* | Best For | Common Risks |

|---|---|---|---|---|

| Air | ~5–10 days | High | High value, urgent, launch-critical | Dim weight, peak surcharges |

| Ocean | ~30–45 days | Low | Heavy/bulky, stable demand | Longer cash cycle, schedule variability |

| Express (courier) | ~2–5 days | Highest | Samples, very small consignments | Steep cost beyond a few boxes |

Relative, varies by lane, season, and packaging efficiency.

A hybrid strategy works well: fly the urgent 20%, float the rest. That keeps revenue moving while protecting margin.

Choosing a Forwarder: A Buyer’s Checklist

Use this quick test before you commit:

Credentials & focus

- Demonstrates recent China–U.S. case studies in your category.

- Offers real capacity during peak without bait-and-switch routings.

Transparent economics

- Provides a written, itemized quote (origin, linehaul, destination, extras).

- States how volumetric weight is calculated and which divisor is used.

- Shares service SLAs and liability limits in plain English.

Compliance and delivery

- Performs pre-clearance document checks.

- Has U.S. brokerage coverage and local delivery capability (including FBA familiarity).

- Provides live tracking and named points of contact.

Green / Yellow / Red flags

- Green: proactive on docs, consistent updates, references available.

- Yellow: cheap headline rate, vague on what’s included.

- Red: refuses to state dim divisor, won’t confirm Incoterms responsibilities, “it’ll be fine” answers on restricted items.

Five RFP questions that separate pros from pretenders

- What’s your plan B if the booked flight cancels?

- How do you calculate chargeable weight on my packaging?

- Which destination fees are not in your quote?

- What recent issues have you cleared for clients with my HS codes?

- Can you show two shipments similar to mine delivered on time in the last 60 days?

A Simple Action Plan (Use This Before You Book)

- Score the shipment. Note value/kg, cube, launch/season dates, and the cost of a stockout.

- Pick a mode (or blend). If a stockout would cost more than the air premium, fly a bridge lot and ocean the rest.

- Fix the packaging. Trim volumetric weight; confirm carton and master sizes against airline limits.

- Get like-for-like quotes. Door-to-door, all-in, written fee tables, clear Incoterms.

- Pre-clear documents. Lock HS codes, licenses, and accurate commercial invoices before pickup.

- Reserve capacity early. Especially 4–8 weeks ahead of known peaks (back-to-school, Q4 holidays).

- Measure and iterate. Track actual door-to-door, damage rates, and true landed cost; adjust the mix every month.

Closing Thoughts

Speed isn’t just a convenience—often it’s the difference between capturing demand and apologizing for a backorder. Air freight won’t fit every SKU, and it shouldn’t. But when you use it deliberately—backed by clean packaging, right-sized lots, tidy paperwork, and a forwarder that tells you the whole story up front—it becomes a sharp tool for winning markets, not a panic button.

Plan with realistic timelines, get the economics on paper, and choose partners who earn your trust shipment after shipment. Do that, and flying the right cargo at the right time will feel less like a gamble and more like good business.