Trading on a 5-minute chart can feel overwhelming. Markets move fast, and traders often struggle to spot clear entry or exit points. This confusion can lead to missed opportunities or costly mistakes.

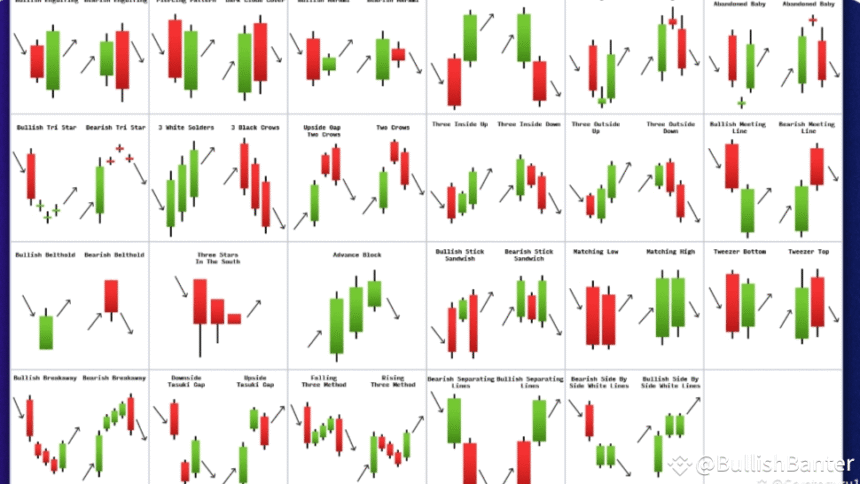

Candlestick patterns offer a dependable way to analyze price action in short timeframes. These patterns provide insights into market sentiment, helping traders predict potential reversals or trends.

For both beginners and experienced traders, mastering these patterns is essential for better decision-making.

In this blog, you will learn the most effective candlestick patterns for 5-minute trading setups. With these tools, you will make quicker decisions with greater confidence. Keep reading to enhance your trading skills today!

Importance of 5-Minute Candlestick Patterns for Trading

Traders use 5-minute candlestick patterns to efficiently evaluate market behavior. These patterns assist in anticipating price movements and identifying opportunities within short timeframes.

Quick decision-making

Quick decision-making is essential in short-term trading, especially with 5-minute candlestick patterns. These patterns provide traders with critical market signals in real-time, allowing them to act swiftly.

For example, spotting a bullish engulfing pattern can indicate a potential upward price move, prompting immediate buy decisions.

Short timeframes leave little room for hesitation. Candlestick analysis helps identify momentum shifts and market reversals quickly. “The faster you understand the chart, the better your chances of making profitable trades,” says seasoned traders across markets.

Identifying market sentiment

Traders assess market sentiment by analyzing candlestick wicks, body sizes, and positioning. A long wick indicates rejection of a price level, suggesting possible reversals or resistance.

Small bodies imply indecision in the market, while large bodies often demonstrate strong trends.

Volume is essential in reading sentiment. Increasing volume with bullish patterns may indicate stronger buying momentum. On the other hand, bearish patterns paired with high volume could reflect intense selling pressure.

Identifying these cues aids in pinpointing entry and exit opportunities effectively.

Entry and exit signals

Entry signals help traders identify the right moment to open a position. Look for candlestick patterns like hammers or bullish engulfing near support levels. Combine these with rising volume and technical indicators such as moving averages for confirmation.

Strong price action after a pattern often suggests upward momentum in short-term trading.

Exit signals indicate when to close trades and secure profits or cut losses. Watch for bearish patterns like evening stars or doji at resistance levels. Sudden price reversals, dropping momentum, or crossing below key indicators signal caution.

Pair these signs with risk management strategies to protect your capital effectively.

Risk management

Effective risk management protects capital and minimizes losses in short-term trading. Traders should establish a fixed percentage of their account they are willing to lose per trade, often between 1% and 2%.

Adhering to this limit prevents significant damage during volatile market conditions.

Stop-loss orders serve as important tools for managing risks. For example, when trading patterns like the Hammer or Doji, placing a stop loss just below the pattern’s low protects against unexpected reversals.

Maintaining appropriate risk-reward ratios further ensures profitable trades outweigh losses. Understanding candlestick analysis connects directly to pattern formation next.

Key Features of 5-Minute Candlestick Patterns

These patterns reveal insights into price movement, helping traders make confident decisions quickly.

Understanding pattern formation

Candlestick patterns take shape by illustrating the connection between an asset’s opening, closing, high, and low prices within a specified time frame. Traders study these shapes to understand price action and anticipate market movements.

Patterns indicate whether buyers or sellers have momentum control in short-term trading.

The body of the candlestick represents the difference between the open and close prices. Shadows above or below display how far prices fluctuated during that period. A long upper shadow can suggest selling pressure, while a long lower shadow may point to buying interest.

Observing these details assists traders in identifying bullish or bearish signals for their strategies in 5-minute setups.

Volume and price correlation

Volume often reflects the strength behind price movements. Significant volume alongside a notable price change indicates strong market interest and affirms trend direction.

Minimal volume during a price increase or decrease might indicate weakness or lack of confidence among traders. In 5-minute trading setups, integrating candlestick patterns with volume analysis enhances decision-making and minimizes false signals.

High-Impact 5-Minute Candlestick Patterns

Learn how certain candlestick patterns can signal strong market moves in short-term trading setups.

Doji

A doji candlestick pattern signals market indecision. It forms when the opening and closing prices are nearly identical, creating a small or nonexistent body with long wicks on both ends.

This shape indicates that neither buyers nor sellers controlled the price during that period.

Traders often watch for dojis in 5-minute charts to identify potential reversals or pauses in trends. For example, a doji at the top of an uptrend may suggest weakening momentum and a possible reversal downward.

Pairing it with technical indicators like moving averages can enhance trading strategies while reducing false signals in short-term setups.

Hammer

The hammer is a bullish reversal candlestick pattern. It forms after a downtrend and indicates potential price recovery. This pattern has a small real body near the top with a long lower shadow, reflecting selling pressure followed by strong buying interest.

The upper shadow is usually very minimal or absent.

Traders often look for hammers near key support levels to confirm market reversals. For higher accuracy, combine this pattern with volume analysis or other technical indicators like moving averages.

Next, examine how the bullish engulfing builds on momentum shifts in trading setups.

Bullish Engulfing

A bullish engulfing pattern occurs when a green candlestick completely covers the previous red one. This indicates that buyers have gained control and may push prices upward, generating strong momentum.

Traders often interpret it as an initial sign of a possible reversal in downward-trending markets.

This pattern is most effective when accompanied by high volume on the green candle. It generally forms near support levels or at the conclusion of pullbacks during uptrends. Numerous traders consider it an entry signal alongside technical indicators like moving averages to confirm strength.

Bearish Engulfing

Bearish Engulfing patterns signal market reversals in short-term trading. This pattern occurs when a large bearish candle completely engulfs the previous smaller bullish candle. It indicates strong selling momentum and suggests a potential price drop.

Traders rely on this setup to identify exit points or enter short positions. Confirmations like high trading volume strengthen its reliability. Spotting it on 5-minute charts helps traders make quick decisions, improving their technical analysis approach.

Moving ahead, understanding other candlestick patterns like Morning Star assists in refining strategies effectively.

Morning Star

The Morning Star signals a potential upward reversal in short-term trading. It forms after a downtrend and consists of three candles. The first is a long bearish candle, followed by a small-bodied candle (often showing indecision), and ends with a strong bullish candle that closes above the midpoint of the first one.

Traders often rely on it to identify upward momentum or entry points. This pattern reflects buyers gaining control after sellers dominated. Combining the Morning Star with technical indicators, such as moving averages, can confirm its reliability.

Consistent volume increase during this setup enhances its validity.

Evening Star

Following the Morning Star, which signals potential bullish reversals, the Evening Star indicates potential bearish market reversals. This three-candle pattern forms at the peak of an upward trend and warns traders of a possible downtrend.

It consists of a strong bullish candle, followed by a small-bodied candle (which can be red or green), and ends with a large bearish candle that closes near or below the midpoint of the first bullish one.

Traders often rely on this pattern for short-term trading setups as it shows weakening buying momentum. Combining candlestick analysis with other technical indicators like moving averages or RSI helps confirm reliability before entering trades.

Volume typically increases during formation, signaling commitment to price action shifts. Apply strict risk management strategies when trading based on this setup to avoid losses in volatile markets.

Advanced Candlestick Patterns for Enhanced Trading

Traders can improve their skills by studying advanced candlestick patterns for better accuracy. These patterns often indicate possible changes in market trends, providing important insights.

Spinning Top

A spinning top candlestick pattern reflects market uncertainty. It features a small body with extended wicks on both sides, suggesting that buyers and sellers are evenly matched. This pattern often suggests a possible change or halt in the existing trend.

The proportion of the wicks to the body is essential for interpretation. In significant 5-minute trading strategies, traders examine this pattern with technical tools such as moving averages to validate signals.

Minimal volume during these formations might reduce dependability.

Hanging Man

The Hanging Man signals a possible market reversal during an uptrend. Traders often recognize this bearish pattern when the candlestick forms with a small body near the top of its range and a long lower shadow.

This indicates that sellers temporarily gained control but could not maintain momentum.

Significant trading volume during its formation enhances the credibility of this price action signal. For confirmation, traders look for a bearish candle immediately following this pattern to confirm downward momentum.

The Hanging Man is more reliable when used alongside other technical indicators such as moving averages or RSI for short-term trading strategies.

Inverted Hammer

An inverted hammer appears in a downtrend. It indicates a possible reversal of bearish momentum. Its candle has a small real body and a long upper wick, with little to no lower shadow.

This pattern reflects buyers attempting to gain control after sellers dominated earlier in the session.

Traders often verify this signal by waiting for the next candle to close higher. Significant trading volume during its formation enhances reliability. Combining it with technical indicators like moving averages or RSI aids in improving accuracy in short-term trading setups.

Bullish Harami

The inverted hammer indicates a possible turning point of a downward trend, while the bullish harami provides another essential sign for changes in price movement. A bullish harami develops over two candles during a downward trend.

The first candle is large and bearish, reflecting significant selling pressure. The second candle is smaller and rests within the body of the first.

This pattern implies reduced selling momentum and indicates a potential forthcoming trend shift. Traders frequently combine it with technical indicators such as moving averages to verify strength before committing to long positions.

Applying tight stop-loss orders below the recent low aids in managing risk effectively when trading this candlestick pattern.

Strategies for Trading 5-Minute Candlestick Patterns

Apply clear strategies to trade 5-minute candlestick patterns and improve your short-term trading decisions.

Bullish pattern strategies

Spot a bullish engulfing pattern on the chart. Enter a long position when the second candle fully engulfs the previous red candle, signaling strong buying pressure. Place stop-loss orders below the low of the engulfing candle to manage risk.

Use hammer patterns during downtrends to identify reversals. Look for small bodies with long lower shadows and enter trades after confirming upward momentum in subsequent candles. Combine these patterns with technical indicators like moving averages for stronger signals in short-term trading strategies.

Bearish pattern strategies

Traders use bearish patterns to anticipate potential price drops. The bearish engulfing pattern indicates strong selling pressure when a larger red candlestick completely covers the previous green candle.

This often points to an imminent market reversal or downtrend continuation. Look for confirmation with high volume to enhance your analysis.

The evening star highlights weakening momentum after an uptrend. It forms with three candles: a large green one, a small-bodied one, and finally a long red candle closing below the midpoint of the first.

These setups can assist traders in planning short positions effectively while managing risks through stop-loss orders. Handling false signals becomes critical in such strategies.

Managing false signals

Bearish patterns might suggest potential price drops, but misleading signals can result in poor decisions. Concentrate on verifying patterns with volume analysis and other technical indicators like moving averages or RSI.

Exercise caution during times of low market volatility as they heighten the risk of misreading candlestick charts. Experiment with short-term trading strategies in a demo account before implementing them in live trades for improved precision.

Incorporating technical indicators

Traders often rely on technical indicators to verify candlestick patterns in 5-minute setups. Moving averages assist in identifying trends and determining support or resistance levels.

For example, a bullish engulfing pattern above the 20-period moving average indicates strong upward movement.

Momentum trading depends on indicators such as Relative Strength Index (RSI) and MACD. RSI points out overbought or oversold conditions, aligning with price action signals from patterns like Doji or Hammer.

Combine these tools with volume analysis for improved precision when initiating trades.

Rules for Effective 5-Minute Trading Setups

Follow strict entry and exit rules to avoid impulsive decisions. Stick to a clear plan for consistent results in short-term trading.

Entry rules

Start trades after identifying clear candlestick patterns. Confirm the pattern with strong volume and price movement to avoid false signals. Use technical indicators like moving averages or RSI for added confidence in your setup.

Align entries with bullish or bearish trends visible on the chart. For instance, enter a trade when a hammer forms at support during an uptrend or when a bearish engulfing appears near resistance in a downtrend.

Keep stop-loss levels tight to manage risk effectively.

Exit rules

Exiting trades at the right time safeguards profits and minimizes losses. Look for reversal candlestick patterns like Doji or Evening Star to indicate potential trend changes. Combine these patterns with technical indicators, such as moving averages, to validate exit points.

Place stop-loss orders below important support levels in long trades or above resistance levels in short trades. Adjust your stop-loss as price moves favorably, securing gains while leaving room for momentum trading opportunities.

Avoid exits driven purely by fear, and adhere to predefined price action rules for consistency.

Common Mistakes to Avoid in 5-Minute Trading

Traders often rush their decisions without confirming signals. Ignoring proper analysis can lead to avoidable losses.

Misinterpreting patterns

Misreading candlestick patterns can lead to poor trading decisions. A bullish pattern, such as a hammer, may indicate price reversals in some situations but not always guarantee upward momentum.

Relying solely on the appearance of chart formations without considering volume or overall market conditions often results in false conclusions.

Overanalyzing short-term patterns increases emotional trading errors. For example, traders might confuse a Doji for indecision when stronger signals suggest otherwise. Focus on combining candlestick analysis with technical indicators like moving averages or RSI for better confirmation before acting.

Overlooking volume confirmation

Failing to confirm a candlestick pattern with volume data can lead to costly mistakes. Volume shows the strength and conviction behind price moves. For example, a bullish engulfing pattern without increased volume may lack enough momentum for sustained upward movement.

Traders who ignore volume risk entering trades on weak signals. Higher trading volumes often confirm major patterns like hammer or morning star formations. Always check if volume matches your chosen 5-minute setup before making decisions.

This helps filter false signals and improves overall strategy reliability.

Ignoring risk-reward ratios

Overlooking risk-reward ratios results in poor trade decisions. Traders often pursue profits without considering potential losses. This creates imbalance and negatively impacts long-term trading performance.

A well-calculated ratio reduces risks and increases returns over time. For instance, a 1:2 ratio signifies risking $50 to gain $100.

Focusing on risk management avoids emotional trades during volatility. Establishing realistic targets helps remain focused on strategy rather than market distractions. Awareness of risk-reward works effectively with candlestick patterns for accurate entry setups in strategies with bullish or bearish signals.

FAQs

Discover answers to common questions about 5-minute candlestick trading patterns and improve your strategies.

What is the success rate of 5-minute candlestick patterns?

The success rate of 5-minute candlestick patterns depends on market conditions and trader execution. These patterns often work effectively in trending or highly liquid markets, offering clarity on price action.

For day traders, accuracy can range between 60% to 70% with proper risk management and confirmation from technical indicators.

Combining these patterns with tools like moving averages or volume analysis may enhance reliability. Traders should test strategies before live trading to reduce errors. Avoid depending solely on one pattern for decisions as false signals occur frequently in short-term setups.

Are these patterns reliable in all market conditions?

Candlestick patterns often perform effectively in trending markets. They offer strong indications when combined with volume and other technical indicators like moving averages. In stable market conditions, these patterns assist traders in identifying momentum shifts or possible reversals.

However, their dependability decreases in choppy or sideways markets. Price movements may lack clear direction, making the patterns less useful. Traders should always confirm using additional tools to avoid false signals during uncertain conditions.

Adjusting strategies based on current price action is essential for success.

How can traders minimize false signals?

Traders can lower false signals by incorporating candlestick analysis with technical indicators such as moving averages or RSI. These tools assist in confirming price action and offer additional validation before entering a trade.

Paying attention to volume is also essential for steering clear of fake breakouts. Increased trading volume often confirms the reliability of market sentiment shown in the pattern, decreasing the likelihood of deceptive setups in short-term trading.

Conclusion

Mastering significant candlestick patterns can enhance your 5-minute trading setups. These patterns assist in identifying trends, reversals, and key entry points. Pair them with technical indicators for improved precision.

Maintain discipline by adhering to rules and managing risks carefully. With practice, you can improve your short-term trading strategies effectively.