Starting a business is a risky undertaking. Anything can happen anytime, and when they do, it is usually more expensive than planned. Insurance can mitigate these risks and offer assistance during difficulties. Although it may appear initially as an additional cost, the fact is that the proper coverage can save money in the long run. Below are the seven ways in which business insurance may aid in securing finances and stabilizing operations.

1. Coverage in a Case of Property Damage

Property can be damaged by accidents, natural disasters, or even minor accidents. It can get very costly to replace gear, repair buildings, or repair vehicles. Insurance assists in covering these expenses so that the business is not burdened with all the expenses. This safeguard prevents losing money during hard times and enables you to continue your business without losing a lot of money.

2. Paid Legal Expenses

All businesses can be sued. The legal costs, settlement, or court fees are staggering. Insurance can be used to cover these costs and limit the potential of a serious financial loss. Even an unsuccessful claim can be costly in defending a business. When covered, the monetary loss is much less devastating.

3. Support for Employee-Related Claims

The employees are the core of every company. Nevertheless, accidents, injuries, or conflicts can take place at the workplace. The management of such cases without insurance usually results in high payouts. When well covered, the business will be able to offer much-needed support without straining financially. Insurance also tells the employees that the company is concerned about their health, and this can improve trust and morale.

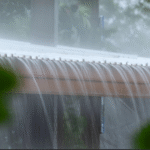

4. Protecting Against Business Disruptions

Some disruptions are not planned, and they cost more than people think. A power outage, storm, or equipment failure could force operations shutdown for days or weeks. In this period, costs keep occurring, and revenue stagnates or halts. Business interruption insurance is created to cover loss of revenue and operating expenses. This assistance prevents the financial decline of a company and helps it recover quickly.

5. Risk Management in Special Industries

Some industries are operating under a greater level of risk than others. The construction firms, restaurants, or transport services have their own predicaments. In the absence of insurance, one hitch can do some serious harm to your finances. As an example, the companies that conduct tours on the water might require charter boat insurance to cover any accidents and property damage. Coverage on this is specialized to cover up risks that the general policies may not cover.

6. Long-Term Savings in Terms of Stability

To have long-term success, financial stability is necessary. One misfortune, with no insurance, could wipe out years of advancement. Insurance assists in avoiding unexpected losses and is able to offer regular assistance. In the long run, stability saves money since the business is free of costly setbacks and there is less need for quick fixes and emergency loans. A stable financial course is a typical element of more growth opportunities. This will help it plan better in its strategy, increase the confidence of its investors, and increase its credit rating. Stability also enables companies to invest their profit, expand, and handle economic recessions in the economy much better, leading to long-term prosperity and survival in the competitive market.

7. Developing Customer and Partner Trust

Most customers and suppliers would like to work with businesses with insurance coverage. It demonstrates competence and accountability. In other instances, contracts can even demand coverage evidence. The presence of insurance can help open new doors to projects and partnerships, which can lead to revenue growth. Greater opportunities are equal to greater income, and this leads to savings over time since the company has a stronger financial standing.

Conclusion

Insurance is not simply another business expense; it can be considered an investment. Insurance prevents financial loss in a number of ways, including by protecting property and employees, covering the cost of legal actions, and business interruption. It also contributes to stability, trust, and keeps businesses on a growth track. The cost that is currently used on coverage can save much more in the future. Insurance is one of the wisest moves that any business can make in order to mitigate risk and safeguard its future.

Sources:

https://www.apex-risk.com/how-much-insurance-does-my-business-need/

https://www.thehartford.com/general-liability-insurance/when-liability-insurance-needed