Though guaranteed investment certificates (GICs) provide a lighthouse of simplicity and assurance, investing might feel like negotiating a maze. Often chosen by risk-averse investors looking for consistent returns as they are But it’s important to know how GIC rates operate and what variables could influence them before you commit. Understanding these specifics will help you to create a very different investment plan that guarantees the highest value for your money.

1. How GIC Rates Are Determined

Though it seems like a simple number, the interest rate on a GIC is affected by various elements. Fundamentally, GIC rates are strongly correlated with the benchmark interest rate of the Bank of Canada and represent the current state of the economy. The best GIC rates usually climb when the central bank increases interest rates to lower inflation. On the other hand, rates usually drop in times of economic downturn. Monitoring these patterns will enable you to choose the ideal moment of investment. Choosing a shorter-term GIC, for example, would enable you to reinvest at greater returns later on when rates are increasing. When they decide rates, lenders also consider their expenses and competitiveness. While bigger banks may depend on their name and ease, a smaller financial institution may provide better rates to draw in business.

2. Fixed vs. Variable Rates

Fixed-rate and variable-rate are the two basic tastes of GICs. Depending on your financial goals and market view, each offers advantages and drawbacks. Providing consistent returns, a fixed-rate GIC assures the same interest rate during its duration. If you value assurance or believe rates of interest will drop, this steadiness is perfect. Particularly well-liked in uncertain economic times are fixed rates as they protect you from any market swings. Conversely, variable-rate GICs have interest rates varying according to a benchmark, such as the prime rate. Investors who think rates will rise over time might find these more appropriate. Although variable rates carry some risk, if your projection turns out to be accurate they can provide better rewards.

3. Term Length Matters

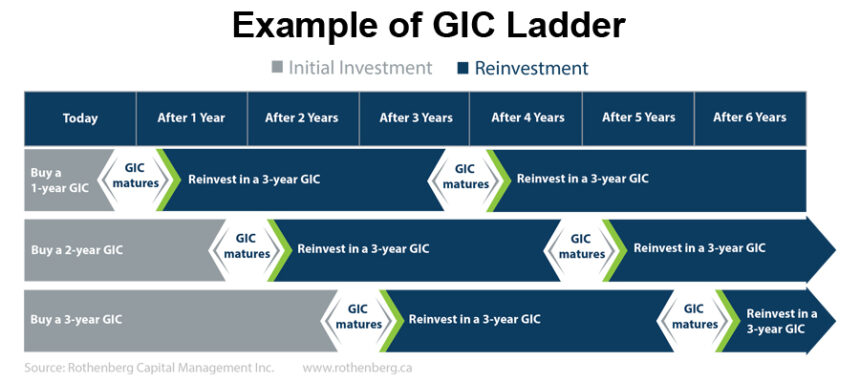

The term duration of a GIC determines your rate exactly. Longer durations usually pay more to offset locking your money for long stretches of time. Still, there is more to think about than only the rate. If you need money or anticipate rising interest rates shortly, short-term GICs—which last a few months to a year—are a terrific choice. They let you reinvest the funds quite fast at maybe better returns. The trade-off, therefore, is often lower interest rates associated with these shorter durations.

4. How Compounding Works

Though not all GICs have this advantage, compound interest is a great instrument for increasing your money. By knowing how and when interest is computed, you may optimize your profits. Simple interest GICs give out periodically—monthly or annually—interest without reinvesting it. If you require a consistent source of money, this is appropriate. You do, however, lose the compounding action, which over time may greatly increase your income. By contrast, compounding GICs returns earned interest back into the principle. This results in exponential growth as you get interest on both your original outlay and the total interest. Your returns are also impacted by the frequency of compounding—daily, monthly, or yearly. You make more the more often it computes.

5. Liquidity and Early Withdrawal Options

Although GICs are well-known for their security, they usually provide little flexibility. If you need access to your money sooner than expected, most GICs want you to lock up your money until the end of the term, which might be disadvantageous. Certain GICs—also known as cashable or redeemable GICs—let you take out money before the term finishes. Though they have less interest rates than non-redeemable GICs, they give you the freedom to retrieve your money should it require it. If you foresee possible liquidity requirements, Cashable GICs are a great option. Although non-redeemable GICs have better rates, early withdrawal usually results in hefty penalties. If you find yourself leaning toward this choice, be sure you won’t need the money throughout the term.

Conclusion

While investing in GICs may be a wise decision for creating financial stability, the optimal one depends on knowing the subtleties of GIC rates. From the elements affecting rates to the terms and choices for flexibility, every element contributes to defining your investment plan. Maximizing your returns while maintaining your money secure requires careful comparison of possibilities, selection of the appropriate sort of rate and term length, and, when feasible, use of compounding. Spend some time assessing your priorities and financial objectives; a GIC that actually suits you will help you to position yourself for success.